Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if:

(a) one or more of the following apply:

(i) under section 152 - 110, a * capital gain (the exempt amount ) of a company or trust is disregarded;

(ii) under section 152 - 110, an amount of income (the exempt amount ) is * non - assessable non - exempt income of a company or trust;

(iii) subparagraph (i) of this paragraph would have applied to an amount (the exempt amount ) except that the capital gain was disregarded anyway because the relevant * CGT asset was * acquired before 20 September 1985;

(iv) subparagraph (i) of this paragraph would have applied to an amount (the exempt amount ) if subsection 149 - 30(1A) and section 149 - 35 had not applied to the relevant asset; and

(b) the company or trust makes one or more payments relating to the exempt amount to an individual (whether directly or indirectly through one or more interposed entities) before the later of:

(i) 2 years after the relevant * CGT event; and

(ii) if the relevant CGT event happened because the company or trust * disposed of the relevant CGT asset--6 months after the latest time a possible * financial benefit becomes or could become due under a * look - through earnout right relating to that CGT asset and the disposal; and

(c) the individual was a * CGT concession stakeholder of the company or trust just before the relevant CGT event.

Note: A normal business payment, for example, a payment of wages, would not be made "in relation to the exempt amount".

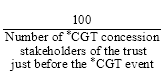

(2) In determining the taxable income of the company, the trust, the individual, or any of the interposed entities, disregard the total amount of the payment or payments made to the * CGT concession stakeholder, up to the following limit:

![]()

where:

"stakeholder's participation percentage" means:

(a) in the case of a company or a trust referred to in item 2 of the table in subsection 152 - 70(1)--the stakeholder's * small business participation percentage in the company or trust just before the relevant * CGT event; or

(b) in the case of a trust referred to in item 3 of that table--the amount (expressed as a percentage) worked out using the following formula:

(3) If a company makes such a payment, this Act applies to the payment, to the extent that it is less than or equal to the limit mentioned in subsection (2), as if:

(a) it were not a * dividend; and

(b) it were not a * frankable distribution.

(4) The Commissioner may extend the time limit under paragraph (1)(b).