Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

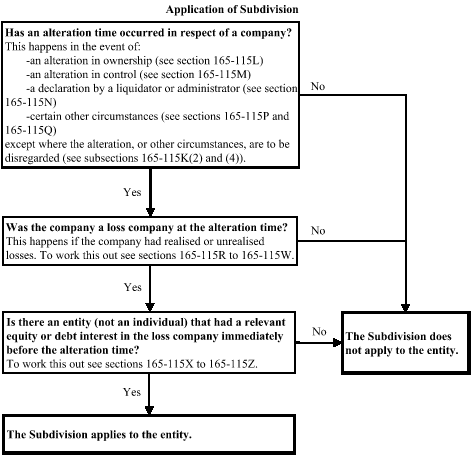

Commonwealth Consolidated Acts(1) This Subdivision provides for certain taxation consequences for an entity (not an individual) that had a significant equity or debt interest in a loss company immediately before an alteration time occurred in respect of the company.

(2) The following flowchart explains how to work out whether this Subdivision applies to an entity.

(3) If this Subdivision applies to an entity, reductions are made to:

(a) the reduced cost base of the entity's equity or debt (see subsection 165 - 115ZA(3)); or

(b) any deduction to which the entity is entitled in respect of the disposal of the equity or debt (see subsection 165 - 115ZA(4)); or

(c) deductions in respect of, and the cost of, any of the equity or debt that is trading stock (see subsection 165 - 115ZA(5)).

Example: The following is an example of how this Subdivision operates:

Facts: Alpha Co acquired 80% of the shares in Beta Co on 5 May 1998 for $1,000.

Gamma Co owns 20% of the shares in Beta Co.

On 6 February 2000, Alpha Co disposed of its shares for $600.

At the beginning of the 1999 - 2000 income year, Beta Co had an unapplied net capital loss of $500 from the 1998 - 99 income year. This loss was fully reflected in the market value of shares in Beta Co.

Alpha Co and Gamma Co are not associated in any way.

Result:

Step 1: An alteration time occurred in respect of Beta Co as a result of the change in ownership that occurred when Alpha Co sold its shares.

Step 2: Beta Co was a loss company at the alteration time because it had an unapplied net capital loss from an earlier income year.

Step 3: Alpha Co had a relevant equity interest in Beta Co immediately before the alteration time because it had a controlling stake and significant interest (80% equity interest). Gamma Co did not have a relevant equity interest in Beta Co because it did not have a controlling stake.

Step 4: Because Alpha Co had a relevant equity interest in Beta Co, the reduced cost bases of its shares in Beta Co are reduced by 80% of Beta Co's net capital loss:

![]()

Alpha Co does not make a capital gain on the disposal of its shares in Beta Co because the capital proceeds ($600) are less than the cost bases ($1,000).

Nor did Alpha Co make a capital loss on the disposal of its shares in Beta Co because the capital proceeds ($600) are not less than the reduced cost bases as further reduced by this Subdivision ($600).

The net capital loss in Beta Co is not duplicated on the sale of Alpha Co's shares in Beta Co.

Step 5. There are no notice requirements in this simple case. If Gamma Co and Alpha Co were associates (so that Gamma Co had a relevant equity interest in Beta Co), Alpha Co would need to provide the following information to Gamma Co:

(a) the alteration time: 6 February 2000;

(b) Beta Co's overall loss at the alteration time: $500;

(c) details of the overall loss: a net capital loss of $500 for the 1998 - 99 income year.

Table of sections

Operative provisions

165 - 115J Object of Subdivision

165 - 115K Application and interpretation

165 - 115L Alteration time--alteration in ownership of company

165 - 115M Alteration time--alteration in control of company

165 - 115N Alteration time--declaration by liquidator or administrator

165 - 115P Notional alteration time--disposal of interests in company within 12 months before alteration time

165 - 115Q Notional alteration time--disposal of interests in company earlier than 12 months before alteration time

165 - 115R When company is a loss company at first or only alteration time in income year

165 - 115S When company is a loss company at second or later alteration time in income year

165 - 115T Reduction of certain amounts included in company's overall loss at alteration time

165 - 115U Adjusted unrealised loss

165 - 115V Notional losses

165 - 115W Calculation of trading stock decrease

165 - 115X Relevant equity interest

165 - 115Y Relevant debt interest

165 - 115Z What constitutes a controlling stake in a company

165 - 115ZAReductions and other consequences if entity has relevant equity interest or relevant debt interest in loss company immediately before alteration time

165 - 115ZBAdjustment amounts for the purposes of section 165 - 115ZA

165 - 115ZCNotices to be given

165 - 115ZDAdjustment (or further adjustment) for interest realised at a loss after global method has been used