Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The amount of the * franking credit on a * distribution is that stated in the * distribution statement for the distribution, unless that amount exceeds the * maximum franking credit for the distribution.

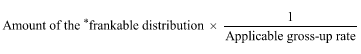

(2) The maximum franking credit for a * distribution is worked out using the formula:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.