Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If an entity makes a * frankable distribution in breach of the * benchmark rule:

(a) the entity is liable to pay over - franking tax imposed by the New Business Tax System (Over - franking Tax) Act 2002 if the * franking percentage for the * distribution exceeds the entity's * benchmark franking percentage for the * franking period in which the distribution is made; and

(b) a * franking debit arises in the entity's * franking account if the franking percentage for the distribution is less than the entity's benchmark franking percentage for the franking period in which the distribution is made.

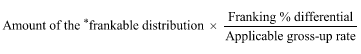

(2) Use the following formula to work out:

(a) in a case dealt with under paragraph (1)(a)--the amount of the * over - franking tax; and

(b) in a case dealt with under paragraph (1)(b)--the amount of the * franking debit:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

"franking % differential" is the difference between:

(a) the * franking percentage for the * frankable distribution; and

(b) either:

(i) if subparagraph (ii) does not apply--the entity's * benchmark franking percentage for the * franking period in which the * distribution is made; or

(ii) if the Commissioner in the exercise of the Commissioner's powers under subsection 203 - 55(1), permits the entity to frank the distribution at a different franking percentage--that percentage.

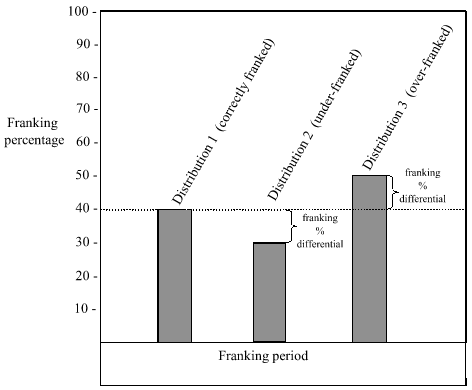

Example: An entity makes 3 successive frankable distributions in a franking period. Each of those distributions is represented in the following diagram. The franking percentage for the first distribution is 40%, and so the entity's benchmark franking percentage for the period is 40%.

Note: Distribution 2 is under - franked to the extent of the franking % differential. This is used to work out the amount of the under - franking debit under subsection (2).

Distribution 3 is over - franked to the extent of the franking % differential. This is used to work out the amount of over - franking tax on the distribution under the New Business Tax System (Over - franking Tax) Act 2002 . The amount of the tax is calculated using the same formula as that set out in subsection (2).

(3) A * franking debit arising under paragraph (1)(b) is in addition to any franking debit that would otherwise arise for the entity because of the * distribution.

(4) The * franking debit arises on the day on which the * frankable distribution is made.