Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This Subdivision applies to an entity if the difference between:

(a) the * benchmark franking percentage for the entity for a * franking period (the current franking period ); and

(b) the benchmark franking percentage for the entity for the last franking period in which a * frankable distribution was made (the last relevant franking period );

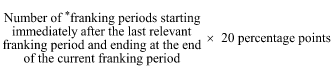

is more than the amount worked out using the following formula (whether the percentage for the current franking period is more than or less than the percentage for the last relevant franking period):

(2) However, this Subdivision does not apply to an entity to which the benchmark rule does not apply.

Note: Section 203 - 20 identifies the entities to which the benchmark rule does not apply.