Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsWhole of share of distribution not assessable

(1) If:

(a) a * franked distribution * flows indirectly to an entity in an income year; and

(b) the entity's * share of the distribution would, in its hands, be * exempt income or * non - assessable non - exempt income (whether or not it had actually received that share);

then, for the purposes of this Act:

(c) subsection (2), (3) or (4) (as appropriate) applies to the entity in relation to that income year; and

(d) the entity is not entitled to a * tax offset under this Division because of the distribution; and

(e) if the distribution flows indirectly through the entity to another entity--subsection 207 - 35(3) and section 207 - 45 do not apply to that other entity.

Note: This section can therefore apply, for example, where the entity is a partner in a partnership that has a partnership loss and the entity does not actually receive any of the distribution.

(2) If the * franked distribution * flows indirectly to the entity as a partner in a partnership under subsection 207 - 50(2), the entity can deduct an amount for that income year that is equal to its * share of the * franking credit on the distribution.

Beneficiary

(3) If the * franked distribution * flows indirectly to the entity as a beneficiary of a trust under subsection 207 - 50(3), the entity can deduct an amount for that income year that is equal to the lesser of:

(a) its share amount in relation to the distribution that is mentioned in that subsection; and

(b) its * share of the * franking credit on the distribution.

(4) If the * franked distribution * flows indirectly to the entity as the trustee of a trust under subsection 207 - 50(4), the entity's share amount in relation to the distribution that is mentioned in that subsection is to be reduced by the lesser of:

(a) that share amount; and

(b) its * share of the * franking credit on the distribution.

Example: A franked distribution of $70 is made to a partnership.

Under section 207 - 35, an additional amount of $30 is included in the partnership's assessable income because of the distribution.

The partnership has 2 equal partners, X and Y. X is a foreign resident individual whose share of partnership's net income for the income year is $50 (share of distribution of $35 and share of franking credit of $15). That share of distribution is not assessable income and not exempt income under section 128D of the Income Tax Assessment Act 1936 .

X's assessable income of $15 (share of franking credit) is reduced to nil because of the deduction of $15 under subsection (2). Because of subsection (1), X is not entitled to a tax offset under section 207 - 45.

Part of share of distribution not assessable

(5) If:

(a) a * franked distribution * flows indirectly to an entity in an income year; and

(b) a part of the entity's * share of the distribution (the relevant part ) would, in its hands, be * exempt income or * non - assessable non - exempt income(whether or not it had actually received that part);

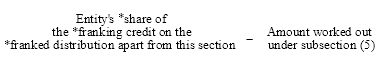

then, subsection (2), (3) or (4) (as appropriate) applies to the entity on the basis that the amount of its * share of the * franking credit on the distribution is worked out as follows:

(6) In addition, the following apply to an entity covered by subsection (5):

(a) if the distribution would otherwise * flow indirectly through the entity--the entity's * share of the distribution for the purposes of this Act (other than subsection (2), (3) or (4)) is to be reduced by the relevant part mentioned in subsection (5);

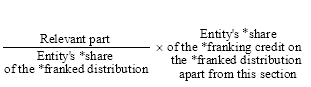

(b) if the entity would otherwise be entitled to a * tax offset under this Division because of the distribution--the amount of the tax offset is to be worked out as follows: