Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

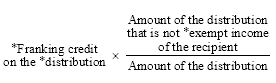

Commonwealth Consolidated Acts(1) Use the following formula to work out:

(a) the amount of an * exempting credit arising under item 2 of the table in section 208 - 115 because a * former exempting entity receives a * distribution * franked with an exempting credit; or

(b) the amount of a * franking credit arising under item 2 of the table in section 208 - 130 because an * exempting entity receives a distribution franked with an exempting credit;

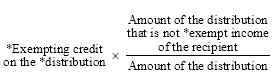

(2) Use the following formula to work out the amount of a * franking credit arising under item 5 of the table in section 208 - 130 because an * exempting entity receives a * distribution * franked with an exempting credit: