Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The * superannuation provider in relation to a * complying superannuation fund or a * complying approved deposit fund (the transferor ) may reduce the amount that would otherwise be included in the fund's assessable income for an income year under Subdivision 295 - C by agreement with another entity (the transferee ) in which it holds investments.

What the transferee must be

(2) The transferee must be a * life insurance company or a * pooled superannuation trust.

Note: Amounts transferred are included in the transferee's assessable income: see section 295 - 320 (for PSTs) and paragraph 320 - 15(1)(i) (for life insurance companies).

Agreement requirements

(3) The transferor may make one agreement only for an income year with a particular transferee.

(4) An agreement:

(a) must be in writing, and must be signed by or for the transferor and transferee; and

(b) must be made by the day the transferor lodges its * income tax return for its income year to which the agreement relates; and

(c) cannot be revoked.

Limits on transfer

(5) The total amount covered by the agreements cannot exceed the amount that would otherwise be included in the transferor's assessable income under Subdivision 295 - C for that income year.

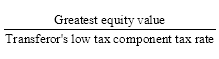

(6) The amount covered by an agreement with a particular transferee cannot exceed this amount:

where:

"greatest equity value" is the greatest of these amounts during the transferor's income year:

(a) if the transferee is a * pooled superannuation trust--the * market value of the transferor's investment in units in the trust;

(b) if not--the market value of the transferor's investment in:

(i) * life insurance policies issued by the transferee; or

(ii) a trust whose assets consist only of life insurance policies issued by the transferee.

"transferor's low tax component tax rate" is the rate of tax imposed on the * low tax component of the fund's taxable income for the income year.