Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A proportion of the * ordinary income and * statutory income of a * complying superannuation fund that would otherwise be assessable income is exempt from income tax under this section. The proportion is worked out under subsection (3).

Exception

(2) Subsection (1) does not apply to:

(a) * non - arm's length income; or

(b) amounts included in assessable income under Subdivision 295 - C; or

(c) income * derived from * segregated non - current assets; or

(d) income that is exempt from income tax under section 295 - 385.

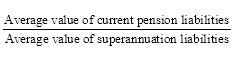

(3) The proportion is:

where:

"average value of" current pension liabilities is the average value for the income year of the fund's current liabilities (contingent or not) in respect of * RP superannuation income stream benefits of the fund at any time in that year. This does not include liabilities for which * segregated current pension assets are held.

"average value of" superannuation liabilities is the average value for the income year of the fund's current and future liabilities (contingent or not) in respect of * superannuation benefits in respect of which contributions have, or were liable to have, been made. This does not include liabilities for which * segregated current pension assets or * segregated non - current assets are held.

Actuary's certificate

(4) The value of particular liabilities of the fund at a particular time is the amount of the fund's assets, together with future contributions in respect of the benefits concerned and expected earnings on the assets and contributions after that time, that would provide the amount required to discharge those liabilities as they fall due. This must be specified in an * actuary's certificate obtained by the trustee of the fund before the date for lodgment of the fund's * income tax return for the income year.

(5) The expected earnings are worked out at the rate the actuary expects will be the rate of the fund's earnings on its assets (except * segregated current pension assets or * segregated non - current assets).

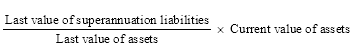

Superannuation liabilities where no current certificate

(6) The superannuation liabilities do not have to be valued by an actuary for the income year if the fund has no * segregated current pension assets or * segregated non - current assets for the income year. Instead, the value can be worked out using this formula:

where:

"current value of assets" is the value of all of the fund's assets at a time in the income year, as specified in an * actuary's certificate obtained by the trustee of the fund before the date for lodgment of the fund's * income tax return for the income year.

"last value of assets" is the most recent value of all of the fund's assets specified in an * actuary's certificate.

"last value of superannuation liabilities" is the value, at the time of that most recent valuation, of the fund's superannuation liabilities specified in an * actuary's certificate.

Note: This allows a fund to avoid the expense of an actuarial valuation of its superannuation liabilities, except in those years that a valuation is required by the SIS Act in order for the fund to continue to be complying.

(7) Subsections (4), (5) and (6) do not apply in working out the amounts to be used in the formula in subsection (3) if, at all times during the income year, the liabilities of the fund in respect of * RP superannuation income stream benefits of the fund at those times were liabilities in respect of superannuation income stream benefits that are prescribed by the regulations for the purposes of this subsection.