Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

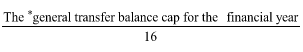

Commonwealth Consolidated Acts(1) Your defined benefit income cap for a * financial year is the following amount (rounded up to the nearest dollar):

(2) Despite subsection (1) of this section, if a particular day in a * financial year is the first day in relation to which section 301 - 10, 301 - 100, 302 - 65 or 302 - 85:

(a) applies to you in respect of an amount of * defined benefit income; or

(b) would apart from this Subdivision apply to you in respect of an amount of defined benefit income;

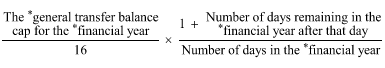

your defined benefit income cap for the financial year is the following amount (rounded up to the nearest dollar):

(3) Despite subsections (1) and (2) of this section, if:

(a) in a case where subsection (1) applies--during the * financial year, you receive any amounts of * defined benefit income to which none of sections 301 - 10, 301 - 100, 302 - 65 and 302 - 85 apply; or

(b) in a case where subsection (2) applies--during the financial year, you receive after the day mentioned in that subsection any amounts of defined benefit income to which none of sections 301 - 10, 301 - 100, 302 - 65 and 302 - 85 apply;

your defined benefit income cap for the financial year under subsection (1) or (2) (as the case requires) is reduced by the sum of those amounts.

Table of sections

303 - 5 Commutation of income stream if you are under 25 etc.

303 - 10 Superannuation lump sum member benefit paid to member having a terminal medical condition

303 - 15 Payments from release authorities--general

303 - 20 Payments from release authorities--paying debt account discharge liability for a superannuation interest