Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a * superannuation lump sum if:

(a) it is not a * roll - over superannuation benefit; or

(b) it is a roll - over superannuation benefit that includes an * element untaxed in the fund, all or part of which will be included in the assessable income of the * superannuation provider in relation to the * superannuation fund into which the benefit is paid.

(2) However, this section applies to the * superannuation lump sum only to the extent that it is attributable to a * superannuation interest that existed just before 1 July 2007.

(3) If the * superannuation lump sum includes an * element untaxed in the fund:

(a) increase the * tax free component of the benefit by the amount that is the lesser of these amounts:

(i) the amount worked out under subsection (4); and

(ii) the amount of the element untaxed in the fund (apart from this section); and

(b) reduce the element untaxed in the fund by the lesser of those amounts.

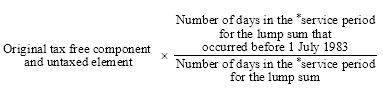

(4) Work out the amount by applying the following formula:

where:

"original tax free component and untaxed element" is the sum of:

(a) the * tax free component of the * superannuation benefit (apart from this section); and

(b) the * element untaxed in the fund of the superannuation benefit (apart from this section).

(5) If the benefit is in part attributable to a * crystallised pre - July 83 amount, in working out the * tax free component of the * superannuation benefit (apart from this section) for the purposes of subsection (4), disregard the amount of the benefit that is attributable to the * crystallised segment of the * superannuation interest from which the benefit is paid.

Table of sections

307 - 200 Regulations relating to meaning of superannuation interests

307 - 205 Value of superannuation interest

307 - 210 Tax free component of superannuation interest

307 - 215 Taxable component of superannuation interest

307 - 220 What is the contributions segment ?

307 - 225 What is the crystallised segment ?

307 - 230 Total superannuation balance

307 - 231 Limited recourse borrowing arrangements