Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You have an amount under this section (an LRBA amount ), in relation to a * regulated superannuation fund in which you have one or more * superannuation interests, if:

(a) the * superannuation provider in relation to the fund has a * borrowing under an * arrangement that is covered by the exception in subsection 67A(1) of the Superannuation Industry (Supervision) Act 1993 (which is about limited recourse borrowing arrangements); and

(b) the borrowing has not been repaid at the time of working out your * total superannuation balance; and

(c) at that time, the asset or assets that secure the borrowing support, to an extent, a superannuation interest of yours; and

(d) the fund is a * small superannuation fund at that time; and

(e) either:

(i) you have satisfied (whether at or before that time) a condition of release specified in paragraph 307 - 80(2)(c); or

(ii) the lender is an * associate of the superannuation provider.

Note: Subsection 318(3) of the Income Tax Assessment Act 1936 sets out when an entity is an associate of a trustee.

(2) The amount of your LRBA amount in relation to the * regulated superannuation fund is the sum of the amounts worked out under subsection (3) for:

(a) if subparagraph (1)(e)(i) applies--each * borrowing that satisfies paragraphs (1)(a), (b) and (c); or

(b) if subparagraph (1)(e)(i) does not apply--each borrowing that satisfies paragraphs (1)(a), (b) and (c) and subparagraph (1)(e)(ii).

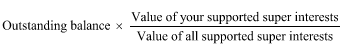

(3) The amount under this subsection, in respect of a * borrowing, is worked out using the following formula:

where:

"outstanding balance" means the outstanding balance on the * borrowing at the time of working out your * total superannuation balance.

"value of all supported super interests" means the sum of the * values at that time of all * superannuation interests in the * regulated superannuation fund that are supported by the asset or assets that secure the * borrowing.

"value of your supported super interests" means the sum of the * values at that time of each * superannuation interest of yours that is supported by the asset or assets that secure the * borrowing.

Table of sections

307 - 275 Element taxed in the fund and element untaxed in the fund of superannuation benefits

307 - 280 Superannuation benefits from constitutionally protected funds etc.

307 - 285 Trustee can choose to convert element taxed in the fund to element untaxed in the fund

307 - 290 Taxed and untaxed elements of death benefit superannuation lump sums

307 - 295 Superannuation benefits from public sector superannuation schemes may include untaxed element

307 - 297 Public sector superannuation schemes--elements set by regulations

307 - 300 Certain unclaimed money payments