Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a * superannuation death benefit that is a * superannuation lump sum, in relation to which a deduction has been, or is to be, claimed under section 295 - 465 or 295 - 470.

Note 1: Those sections allow deductions for insurance premiums that have been paid, and for liability for future benefits.

Note 2: Deductions made under former section 279 or 279B of the Income Tax Assessment Act 1936 are treated for the purposes of this section as having been made under section 295 - 465 or 295 - 470 (see section 307 - 290 of the Income Tax (Transitional Provisions) Act 1997 ).

(2) The * taxable component of the * superannuation lump sum includes an element taxed in the fund worked out as follows:

(a) first, work out the amount under the formula in subsection (3);

(b) next, reduce that amount (but not below zero) by the * tax free component (if any) of the superannuation lump sum.

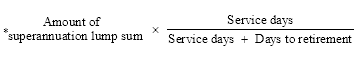

(3) For the purposes of paragraph (2)(a), the formula is:

where:

"days to retirement" is the number of days from the day on which the deceased died to the deceased's * last retirement day.

"service days" is the number of days in the * service period for the lump sum.

(4) The element untaxed in the fund of the * taxable component is the balance of the taxable component.