Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

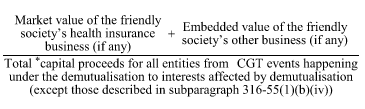

Commonwealth Consolidated Acts(1) For the purposes of sections 316 - 60, 316 - 105 and 316 - 165, the valuation factor is the amount worked out using the formula:

where:

"embedded value of the friendly society's other business (if any)" means the amount that would be the value of the * friendly society worked out under section 316 - 70 assuming that neither the friendly society, nor any health/life insurance subsidiary of it, carried on any health insurance business within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015 .

"market value of the friendly society's health insurance business (if any)" means the total * market value of every health insurance business, within the meaning of the Private Health Insurance (Prudential Supervision) Act 2015 , carried on by either or both of the * friendly society and its health/life insurance subsidiaries (if any), taking account of any consideration paid to the society or subsidiary for disposal or control of that business.

(2) Disregard paragraph 316 - 60(2)(a) for the purposes of the formula in subsection (1) of this section.