Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) An entity is entitled to a * tax offset for an income year (the offset year ) if:

(a) the * Housing Secretary issues an * NRAS certificate in relation to an * NRAS year to a partnership or a trustee of a trust; and

(b) * NRAS rent * derived:

(i) from any of the * NRAS dwellings covered by the NRAS certificate; and

(ii) during the NRAS year;

* flows indirectly to the entity in any income year; and

(c) the offset year of the partnership or trustee begins in the NRAS year; and

(d) the entity is:

(i) an individual; or

(ii) a * corporate tax entity when the NRAS rent flows indirectly to it; or

(iii) the trustee of a trust that is liable to be assessed on a share of, or all or a part of, the trust's * net income under section 98, 99 or 99A of the Income Tax Assessment Act 1936 for the offset year; or

(v) a * superannuation fund, an * approved deposit fund or a * pooled superannuation trust.

Note: The entities covered by this section are the ultimate recipients of the NRAS rent because the NRAS rent does not flow indirectly through them to other entities.

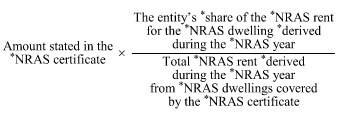

(2) The amount of the * tax offset is the sum of the amounts worked out using the following formula for each * NRAS dwelling from which there is * NRAS rent covered by paragraph (1)(b):

(3) Treat the references in subsection (2) to the * NRAS year as being references to a period that occurs during the NRAS year, if the * NRAS certificate is apportioned for the period.