Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsEntitlement to tax offset

(1) A * member of the * NRAS consortium (other than the electing member) is entitled to a * tax offset for the income year if the member is an individual, a * corporate tax entity or a * superannuation fund.

Amount of tax offset

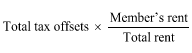

(2) The amount of the * tax offset is the amount worked out using the following formula:

where:

"member's rent" means:

(a) if * NRAS rent was payable for the * NRAS dwelling in relation to the whole of the * NRAS year--the rent * derived by the * member from the NRAS dwelling during the NRAS year; or

(b) if NRAS rent was payable for the NRAS dwelling in relation to only part of the NRAS year--the rent derived by the member from the NRAS dwelling during that part of the NRAS year.

"total rent" means:

(a) if * NRAS rent was payable for the * NRAS dwelling in relation to the whole of the * NRAS year--the rent * derived from the NRAS dwelling during the NRAS year; or

(b) if NRAS rent was payable for the NRAS dwelling in relation to only part of the NRAS year--the rent derived from the NRAS dwelling during that part of the NRAS year.

"total tax offsets" means the total of the * tax offsets to which entities would be entitled under section 380 - 15 or 380 - 20 because of * NRAS rent * derived:

(a) from any of the * NRAS dwellings covered by the * NRAS certificate; and

(b) during the * NRAS year;

that * flows indirectly to them from the electing member (or would otherwise flow indirectly to them from the electing member, as mentioned in paragraph 380 - 20(1)(d)).

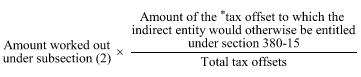

(3) The * tax offset to which the indirect entity would otherwise be entitled under section 380 - 15 for the income year because of the * NRAS certificate and the * NRAS dwelling is reduced by the amount worked out using the following formula:

where:

"total tax offsets" has the same meaning as in subsection (2).

(4) Treat the references in subsection (2) to the * NRAS year as being references to a period that occurs during the NRAS year, if the * NRAS certificate is apportioned for the period.

Amount of tax offset--rent that passes through NRAS approved participant

(5) For the purposes of the references in the definitions in subsection (2) to rent * derived from the * NRAS dwelling during the * NRAS year, disregard * NRAS rent derived by a * member of the * NRAS consortium from the NRAS dwelling during a period in the NRAS year, to the extent that another member derives rent from the NRAS dwelling during the period because:

(a) the first member is the * NRAS approved participant of the NRAS consortium throughout the period; and

(b) the first member, in accordance with the contractual * arrangements that established the NRAS consortium, passes the NRAS rent on to the other member.

Note: There may be more than one NRAS approved participant during an NRAS year. The electing member may be the NRAS approved participant for only part of the NRAS year.

(6) For the purposes of paragraph (5)(b), treat any * NRAS rent retained by the first * member under the * arrangements as management fees or commission as having been passed on to the other member.