Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsApplication

(1) This section applies if an entitlement arises under Division 2AA (Financial claims scheme for account - holders with insolvent ADIs) of Part II of the Banking Act 1959 in connection with an account containing a * farm management deposit (the old deposit ) with an * ADI (the old ADI ) and either:

(a) an amount (the new deposit ) is deposited into either of the following to meet, in whole or part, so much of the entitlement as relates to the old deposit:

(i) an existing account for a farm management deposit;

(ii) an account established under section 16AH of that Act for the purposes of meeting (in whole or part) the entitlement; or

(b) an amount (also the new deposit ) is deposited by a liquidator of the old ADI into either of the following as so much of a distribution from the liquidation of the old ADI as relates to the old deposit:

(i) an existing account for a farm management deposit;

(ii) an account established under section 16AR of that Act for the payment of the distribution.

Note: If an amount is deposited in connection with an account with the old ADI containing 2 or more old deposits, the amount is to be apportioned between each old deposit, so that so much of the amount as is attributable to a particular old deposit is regarded as a distinct new deposit relating to that old deposit.

New deposit is a farm management deposit

(2) This Division (except this section) applies to the new deposit as if the new deposit were a transfer of the old deposit in accordance with a requirement contained in the relevant agreement for the old deposit as set out in item 13 of the table in section 393 - 35 (which allows for transfers of deposits at the request of the depositor). To avoid doubt, this Division applies in that way as if the amount transferred were the amount of the new deposit, even if that is more or less than the amount of the old deposit.

Note 1: The effects of this include the following:

(a) section 393 - 5 (about deductions for making a farm management deposit) does not apply in relation to the making of the new deposit (see paragraphs 393 - 15(1)(c) and (2)(a));

(b) subsection 393 - 10(1) (about assessability of the repayment of a farm management deposit) can only apply to the extent of any difference between the amount transferred and the amount of the old deposit (see paragraphs 393 - 15(1)(c) and (2)(b));

(c) subsections 393 - 40(1), (2) and (4) (about repayment of a farm management deposit within the first 12 months) can only apply to the extent of any difference between the amount transferred and the amount of the old deposit (see paragraphs 393 - 15(1)(c) and (2)(c) and (d));

(d) the day the old deposit was made, for the purposes of subsections 393 - 40(1) and (2) (about repayment of a farm management deposit within the first 12 months) and (3A) and (4) (about repayment in the event of an applicable natural disaster), is maintained for the new deposit (see subsection 393 - 40(6)).

Note 2: Also, the unrecouped FMD deduction in respect of the new deposit is the same as the unrecouped FMD deduction in respect of the old deposit (see subsection 393 - 15(3)), unless subsection (6) or (7) of this section applies because the new deposit is less than the old deposit.

(3) In determining whether either of the following is a * farm management deposit, disregard a requirement contained in an agreement as set out in item 4 of the table in section 393 - 35 (requiring the deposit to be $1,000 or more):

(a) the new deposit;

(b) a deposit made later directly by the transfer of the new deposit in accordance with a requirement of the relevant agreement for the new deposit as mentioned in item 13 of that table.

Unrecouped FMD deduction for new deposit less than old deposit

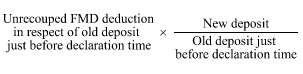

(6) Despite subsection (2) and subsection 393 - 15(3), if the new deposit is less than the old deposit at the time (the declaration time ) the old ADI became a declared ADI under the Banking Act 1959 , the unrecouped FMD deduction in respect of the new deposit is the amount worked out using the following formula:

Note: The new deposit could be less than the old deposit if the entitlement is paid in instalments (each of which will be a separate new deposit).

(7) However, if the amount worked out under subsection (6) is more than the difference (if any) between:

(a) the * unrecouped FMD deduction in respect of the old deposit just before the declaration time; and

(b) the total of the amounts worked out under all previous applications of subsection (6) in relation to that old deposit;

the unrecouped FMD deduction in respect of the new deposit is equal to the difference (if any).

Note: This ensures that when new deposits linked to the old deposit are repaid, the total amount included in assessable income will not exceed the unrecouped FMD deduction in respect of the old deposit.

Relationship with other provisions

(8) This section has effect despite Division 253 (about tax treatment of entitlements under the financial claims scheme for insolvent ADIs).