Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) In addition to section 40 - 290, you must reduce the amount (the balancing adjustment amount ) included in your assessable income, or that you can deduct, under section 40 - 285 for a * depreciating asset if your deductions for the asset have been reduced under section 40 - 27.

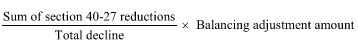

(2) The reduction is the following, as increased under subsection (3) if applicable:

where:

"sum of section 40-27 reductions" is the sum of:

(a) the reductions in your deductions for the asset under section 40 - 27; and

(b) if there has been roll - over relief for the asset under section 40 - 340--the reductions in deductions for the asset for the transferor or an earlier successive transferor under section 40 - 27; and

(c) if you * hold the asset as the * legal personal representative of an individual--the reductions in deductions for the asset for the individual under section 40 - 27.

"total decline" is the sum of:

(a) the decline in value of the * depreciating asset since you started to * hold it; and

(b) if there has been roll - over relief for the asset under section 40 - 340--the decline in value of the asset for the transferor or an earlier successive transferor; and

(c) if you hold the asset as the * legal personal representative of an individual--the decline in value of the asset for the individual.

(3) If:

(a) the * cost (for you) of the asset (the current asset ) was worked out under section 40 - 205 (Cost of a split depreciating asset) or 40 - 210 (Cost of merged depreciating assets); and

(b) you used the * depreciating asset from which the current asset was split, or a depreciating asset that was merged into the current asset, or had it * installed ready for use, for the purpose to which paragraphs 40 - 27(2)(a) and (b) relate;

the reduction includes an increase equal to such amount as is reasonable having regard to the extent of the use referred to in paragraph (b) of this subsection.