Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The decline in value of a * horticultural plant for the income year in which it starts to decline in value is all of the capital expenditure attributable to the establishment of the plant if its * effective life is less than 3 years.

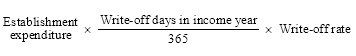

(2) You work out the decline in value for an income year of a * horticultural plant whose * effective life is 3 years or more in this way:

where:

"establishment expenditure" is the amount of capital expenditure incurred that is attributable to the establishment of the * horticultural plant.

"write-off days in income year" is the number of days in the income year on which you satisfied a condition in subsection 40 - 525(2) for the plant and either used it for * commercial horticulture or held it ready for that use.

"write-off rate" is the rate shown in this table for the * horticultural plant according to its * effective life.

Write - off rate for horticultural plant | ||

Item | Effective life of: | The write - off rate is: |

1 | 3 to fewer than 5 years | 40% |

2 | 5 to fewer than 6 2 / 3 years | 27% |

3 | 6 2 / 3 to fewer than 10 years | 20% |

4 | 10 to fewer than 13 years | 17% |

5 | 13 to fewer than 30 years | 13% |

6 | 30 years or more | 7% |

Limit on write - off days

(3) Disregard your use of the * horticultural plant on a day outside the period that:

(a) starts when the plant can first be used for * commercial horticulture; and

(b) extends for the time shown in this table (depending on the plant's * effective life).

Period after which you cannot count use of horticultural plant | ||

Item | Effective life: | Time limit: |

1 | 3 to fewer than 5 years | 2 years and 183 days |

2 | 5 to fewer than 6 2 / 3 years | 3 years and 257 days |

3 | 6 2 / 3 to fewer than 10 years | 5 years |

4 | 10 to fewer than 13 years | 5 years and 323 days |

5 | 13 to fewer than 30 years | 7 years and 253 days |

6 | 30 years or more | 14 years and 105 days |