Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsYour taxable professional income for an income year is the amount (if any) by which your * assessable professional income for that year exceeds the amount of your deductions for that year worked out as follows:

Method statement

Step 1. Add up any amounts you can deduct for that year (except * apportionable deductions), so far as they reasonably relate to your * assessable professional income for the year.

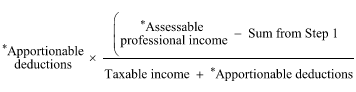

Step 2. Work out the amount using the formula:

Note: The result may be greater than the apportionable deductions. Also, it may be negative.

Step 3. Add the sum from Step 1 to the result from Step 2. If the result is more than nil, it is the amount of your deductions to be subtracted from your * assessable professional income.