Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

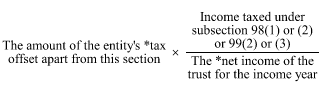

Commonwealth Consolidated Acts(1) If an entity is a trust in relation to which some, but not all, of the liability of the trustee to tax is provided under subsection 98(1) or (2) or 99(2) or (3) of the Income Tax Assessment Act 1936 , the amount of the entity's * tax offset under this Subdivision for an income year is:

where:

"income taxed under subsection 98(1) or (2) or 99(2) or (3)" is the amount of the * net income of the trust, for the income year, in relation to which the trustee is liable to tax under subsection 98(1) or (2) or 99(2) or (3) of the Income Tax Assessment Act 1936 .

(2) If:

(a) an entity is a trust; and

(b) one or more * members of the trust are taken under section 418 - 20 to have been issued with one or more * exploration credits for an income year;

the amount of the entity's * tax offset, under section 418 - 25 or subsection (1) of this section, for the income year is reduced by the sum of amounts of the exploration credits taken to be issued to those members.

Table of sections

418 - 50 Junior minerals exploration incentive franking credit--ordinary case

418 - 55 Junior minerals exploration incentive franking credit--life insurance company