Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

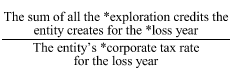

Commonwealth Consolidated Acts(1) If an entity creates any * exploration credits for a * loss year, the amount of the entity's * tax loss for the loss year is reduced by the amount worked out as follows:

(2) However, if the amount worked out under subsection (1) equals or exceeds what would (apart from this section) be the entity's * tax loss for the * loss year, that tax loss is taken to be nil.

Table of sections

418 - 100 Applying for an exploration credits allocation

418 - 101 Determination by the Commissioner

418 - 102 General allocation rules

418 - 103 Meaning of annual exploration cap

418 - 104 Failure to comply with this Subdivision does not affect allocation