Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

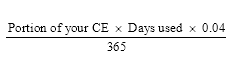

Commonwealth Consolidated ActsStep 1 Calculate the amount worked out using the formula:

where:

"portion of your CE" is the portion of * your construction expenditure that is attributable to the part of * your area that you used in the * 4% manner.

"days used" is the number of days in the income year that:

(a) you owned or were the lessee of that part of * your area and used it in the * 4% manner; or

(b) you were the holder of that part of * your area under a * quasi - ownership right over land granted by an * exempt Australian government agency or an * exempt foreign government agency, and used that part of your area in the 4% manner.

Step 2 Reduce the Step 1 amount by the extent to which the part referred to in Step 1 was used only partly for the * purpose of producing assessable income.

Note: This Step applies if:

• part of your income from the part referred to in Step 1 is exempt income; or

• part of the part referred to in Step 1 was not used for the purpose of producing assessable income or was not available for that use; or

• the part of the part referred to in Step 1 was not used for such a purpose during a part of the days used period.

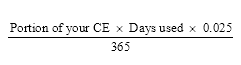

Step 3 Calculate the amount worked out using the formula:

where:

"portion of your CE" is the portion of * your construction expenditure that is attributable to the part of * your area that you did not use in the * 4% manner but was used as described in Table 43 - 140 (Current year use).

"days used" is the number of days in the income year that:

(a) you owned or were the lessee of that part of * your area and used it in that manner; or

(b) you were the holder of that part of * your area under a * quasi - ownership right over land granted by an * exempt Australian government agency or an * exempt foreign government agency, and used that part of your area in that manner.

Step 4 Reduce the Step 3 amount by the extent to which the part referred to in Step 3:

(a) for a * hotel building or * apartment building--was used only partly for the * purpose of producing assessable income; or

(b) for any other capital works--was used only partly for the purpose of * producing assessable income or conducting * R&D activities.

Note: This Step applies if:

• part of your income from the part referred to in Step 3 is exempt income; or

• part of the part referred to in Step 3 was not used for the purpose of producing assessable income (or R&D activities) or was not available for that use; or

• the part of the part referred to in Step 3 was not used for such a purpose during a part of the days used period.

Step 5 Add the Step 2 and Step 4 amounts.

Step 6 The amount of your deduction is the lesser of your Step 5 amount or the * undeducted construction expenditure for * your area.