Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The construction expenditure area of capital works begun after 30 June 1997 is the part of the capital works on which the * construction expenditure was incurred that, at the time when it was incurred by an entity, was to be owned or leased by the entity or held by the entity under a * quasi - ownership right over land granted by an * exempt Australian government agency or an * exempt foreign government agency.

Note: Section 43 - 80 explains when capital works begin.

(2) The construction expenditure area of capital works begun before 1 July 1997 is the part of the capital works on which the * construction expenditure was incurred that:

(a) at the time when it was incurred by an entity, was to be owned or leased by the entity or held by the entity under a * quasi - ownership right over land granted by an * exempt Australian government agency or an * exempt foreign government agency; and

(b) at the time of completion of construction, was to be used in the way described in Column 3 of Table 43 - 90 (intended use at completion) for the time period when the capital works began as set out in Column 1.

(3) There is taken to be a construction expenditure area for capital works purchased by an entity from another entity if:

(a) the capital works would have had a construction expenditure area but for the fact that the other entity did not incur capital expenditure in constructing the capital works; and

(b) the other entity is not an * associate of the entity; and

(c) the other entity constructed the capital works on land that it owned or leased in the course of a business that included the construction and sale of capital works of that kind.

Note: Subsection (3) makes capital works purchased from a speculative builder eligible for deduction in the hands of the first and subsequent purchasers.

(4) The construction of the capital works must be complete before the * construction expenditure area is determined.

(5) Only one * construction expenditure area is created each time an entity constructs capital works.

Example: An entity undertakes the construction of a building. During the course of construction, the entity makes 3 progress payments to the builder. There is still only one construction expenditure area.

(6) A separate * construction expenditure area will be created each time an entity undertakes the construction of capital works.

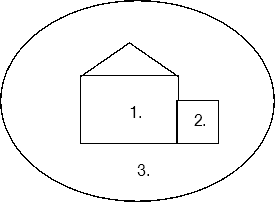

Example: In the diagram below, area 1 relates to the original construction of a building which gives rise to one construction expenditure area . Area 2 is a subsequent extension of the same building which gives rise to another, while area 3 is a later renovation of the entire building which gives rise to another.