Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if the interposed company so chooses under subsection 615 - 30(1).

(2) A number of the * shares or units that the interposed company owns in the original entity (immediately after the completion time) are taken to have been * acquired before 20 September 1985 if any of the original entity's assets as at the completion time were acquired by it before that day.

Note: Generally, a capital gain or capital loss you make from a CGT asset that you acquired before 20 September 1985 can be disregarded: see Division 104.

(3) That number (worked out as at the completion time) is the greatest possible whole number that (when expressed as a percentage of all the * shares or units) does not exceed:

(a) the * market value of the original entity's assets that it * acquired before 20 September 1985; less

(b) its liabilities (if any) in respect of those assets;

expressed as a percentage of the market value of all the original entity's assets less all of its liabilities.

(4) The first element of the * cost base of the interposed company's * shares or units in the original entity that are not taken to have been * acquired before 20 September 1985 is:

(a) the total of the cost bases (as at the completion time) of the original entity's assets that it acquired on or after that day; less

(b) its liabilities (if any) in respect of those assets.

The first element of the * reduced cost base of those shares or units is worked out similarly.

(5) A liability of the original entity that is not a liability in respect of a specific asset or assets of the original entity is taken to be a liability in respect of all the assets of the original entity.

Note: An example is a bank overdraft.

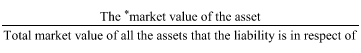

(6) If a liability is in respect of 2 or more assets, the proportion of the liability that is in respect of any one of those assets is equal to:

Table of Subdivisions

620 - A Corporations covered by Subdivision 124 - I