Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The horse opening value is:

(a) if the horse has been your * live stock ever since the start of the income year--its * value as * trading stock at the start of the income year; or

(b) otherwise--the horse's base amount (see subsection (3)).

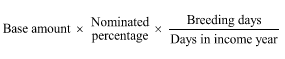

(2) The horse reduction amount is worked out as follows:

(a) for female horses under 12 years of age:

![]()

(b) for any male horse:

(3) In this section:

"base amount" is the lesser of:

(a) the horse's * cost; and

(b) the horse's * adjustable value when it most recently became your * live stock.

"breeding days" is the number of whole days in the income year since you most recently began to hold the horse for breeding.

"nominated percentage" is any percentage, up to 25%, you nominate when you make the election in section 70 - 60.

"reduction factor" is the greater of:

(a) 3; and

(b) the difference between 12 and the horse's age when you most recently began to hold it for breeding.