Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsObject

(1) The object of this section is to modify the effect that section 705 - 93 (step 3A of allocable cost amount) has in accordance with this Subdivision so that it takes account of * membership interests that linked entities hold in other linked entities at the time (the linked entity joining time ) when the linked entities become * subsidiary members of the group.

Apportionment of step 3A amount among first level interposed entities

(2) If:

(a) under section 705 - 93, in its application in accordance with this Subdivision, there is a step 3A amount for the purpose of working out the group's * allocable cost amount for a particular linked entity (the subject entity ); and

(b) at the linked entity joining time, one or more of the linked entities (the first level entities ) in which the * head company holds * membership interests are interposed between the head company and the subject entity;

then the step 3A amount is apportioned among the first level entities and the subject entity on the following basis:

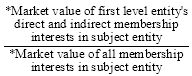

(c) each first level entity has the following proportion of the step 3A amount:

where:

market value of all membership interests in subject entity means the * market value, at the linked entity joining time, of all * membership interests in the subject entity that are held by entities that become * members of the group at that time.

market value of first level entity's direct and indirect membership interests in subject entity means so much of the * market value of all membership interests in the subject entity (as defined above) as is attributable to * membership interests that the first level entity holds directly, or indirectly through other linked entities; and

(d) the subject entity has the remainder of the step 3A amount.

Membership interests in subsidiary members of group

(3) In applying section 705 - 93 for the purposes of this Subdivision, disregard paragraph 705 - 93(1)(f) if:

(a) the rollover asset mentioned in that section is a * membership interest in an entity that becomes a * subsidiary member at the linked entity joining time; and

(b) the rollover asset is not held at that time by the entity that becomes the * head company of the group.

Note: The step 3A amount is worked out under section 705 - 93.