Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

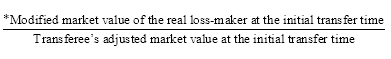

Commonwealth Consolidated Acts(1) The available fraction for a * bundle of losses at a time is:

where:

"transferee's adjusted market value at the initial transfer time" means the amount that would be the * market value, at the initial transfer time, of the transferee to which the losses in the * bundle were transferred at that time if:

(a) the transferee did not have a loss of any * sort for an income year ending before that time; and

(b) the balance of the transferee's * franking account were nil at that time.

Note: The value for the transferee will be worked out on the basis that subsidiary members of the consolidated group headed by the transferee are part of the transferee, because of section 701 - 1 (the single entity rule).

(2) However, if an event described in an item of the table happens, the available fraction for the * bundle is reduced or maintained just after the event by multiplying it by the factor identified in the item:

Factors affecting the available fraction | ||

Item | Event | Factor |

1 | One or more losses in the * bundle are transferred for the second or subsequent time | The lesser of 1 and this fraction:

|

2 | At the same time as the losses in the * bundle were most recently transferred, losses in one or more other bundles were transferred from the same transferor to the same transferee, and the losses in the bundle or one of the other bundles had not been transferred before | The result of dividing the lesser of: (a) the available fraction (apart from this subsection) for the bundle of losses that had not been transferred before; and (b) 1; by the sum of the available fractions for all the bundles (apart from this item applying to transfers at the time) |

3 | The company to which the losses in the * bundle were most recently transferred has transferred to it at a later time losses in one or more other bundles |

|

4 | There is an increase in the * market value of the company to which the losses in the * bundle were most recently transferred, because of an event described in subsection 707 - 325(4) (but not covered by subsection 707 - 325(5)) |

|

5 | The available fractions (apart from this item) for all the * bundles of losses most recently made by the company that most recently made the losses in the bundle total more than 1.000 |

|

(3) If the transfer under Subdivision 707 - A of one or more losses in a * bundle causes events described in 2 or more items of the table in subsection (2) to happen and require calculations of the available fraction for that bundle and for one or more other bundles:

(a) make the calculations required by those items in the order in which the items appear in the table; and

(b) take account of the results of a calculation under an earlier item in making a calculation under a later item.

(4) For a * bundle of losses:

(a) subject to paragraph (b)--the available fraction is worked out to 3 decimal places, rounding up if the fourth decimal place is 5 or more; or

(b) if the available fraction worked out under paragraph (a) is 0.000 and, if it were worked out to more decimal places, it would include one or more non - zero digits--the available fraction is worked out to the number of decimal places that includes the first or only such digit, rounding up if the next decimal place is 5 or more.

Examples: For 0.000328, the available fraction is 0.0003. For 0.000086, the available fraction is 0.00009.

(4A) Subsections (1) and (2) have effect subject to subsection (4).

(5) If, apart from this subsection, the available fraction for a * bundle of losses would need to be worked out by dividing a number by 0, work out the available fraction by dividing the number by 1.

(6) The available fraction for a * bundle of losses is 0 if, apart from this subsection, it would be negative.