Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section affects the * available fraction for each * bundle of losses that were transferred to the ongoing head company under Subdivision 707 - A before the application event.

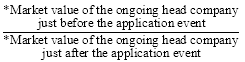

(2) The available fraction for the * bundle is reduced or maintained just after the event by multiplying it by this fraction:

Note: The market value of the ongoing head company at the time just before or just after the application event will be worked out on the basis that subsidiary members of the MEC group or consolidated group headed by the ongoing head company at that time are part of the ongoing head company, because of section 701 - 1 (the single entity rule).

(3) Item 3 of the table in subsection 707 - 320(2) does not apply to affect the * available fraction for the * bundle because of:

(a) the transfer mentioned in section 719 - 305; or

(b) the transfer (if any) to the ongoing head company of a loss of any * sort under Subdivision 707 - A at the time of the application event from an entity that became a * subsidiary member of the * MEC group as a result of the event.