Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The * reduced cost base of a * primary equity interest, * secondary equity interest, or * indirect primary equity interest, in a company or trust is reduced just before a * realisation event that is a * CGT event happens to the interest if:

(a) apart from this Division, a loss would be * realised for income tax purposes by the CGT event; and

(b) apart from this Division, a loss would have been * realised for income tax purposes by a realisation event if the event had happened, just before the CGT event, to a * CGT asset (the underlying asset ) that the company or trust then owned and that:

(i) was not then a * depreciating asset; or

(ii) was then an item of * trading stock of the company or trust; or

(iii) was then a * revenue asset of the company or trust; and

(c) the loss referred to in paragraph (b) would have been reduced under Subdivision 723 - A by an amount (the underlying asset loss reduction ); and

(d) for the entity (the transferor ) that owned the interest just before the CGT event, the interest was a * direct roll - over replacement or * indirect roll - over replacement for the underlying asset.

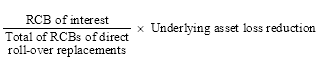

(2) If the interest was a * direct roll - over replacement, its * reduced cost base is reduced by the amount worked out using this formula, unless that amount does not appropriately reflect the matters referred to in subsection (4):

(3) For the purposes of the formula in subsection (2):

"RCB of interest" means the interest's * reduced cost base when the transferor * acquired it.

"total of RCBs of direct roll-over replacements" means the total of the * reduced cost bases of all * direct roll - over replacements for the underlying asset when the transferor * acquired them.

(4) If:

(a) the interest was an * indirect roll - over replacement; or

(b) the amount worked out under subsection (2) does not appropriately reflect the matters referred to in this subsection;

the interest's * reduced cost base is reduced by an amount that is appropriate having regard to these matters:

(c) the underlying asset loss reduction; and

(d) the quantum of the interest relative to all * direct roll - over replacements and indirect roll - over replacements that the transferor owns or has previously owned.