Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsUse the following method statement:

(a) to work out the amount of the gain for a * taxing event generating a gain under:

(i) section 725 - 245; or

(ii) item 2, 4 or 7 of the table in subsection 725 - 335(3); and

(b) to work out the decrease in * adjustable value of a * down interest under:

(i) item 1, 2, 3, 4 or 6 of the table in subsection 725 - 250(2); or

(ii) item 1, 2, 4 or 7 of the table in subsection 725 - 335(3).

Method statement

Step 1. Group together all * down interests that:

(a) are of the kind referred to in the relevant item; and

(b) immediately before the * decrease time, had the same * adjustable value as the down interest; and

(c) immediately before that time had the same * market value as the down interest; and

(d) sustained the same decrease in market value as the down interest because of the * direct value shift.

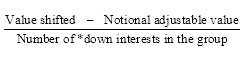

Step 2. Work out the value shifted from that group of * down interests to the * up interests referred to in the relevant item using the following formula:

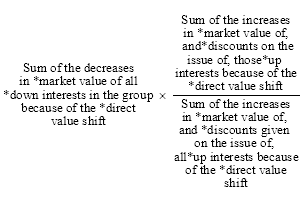

Step 3. Work out the notional adjustable value of the value shifted from that group of * down interests to those * up interests using the formula:

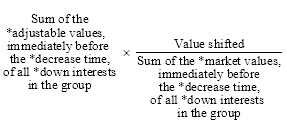

Step 4. The decrease in the * adjustable value of the * down interest under the relevant item is equal to:

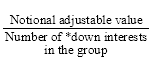

Step 5. For a * taxing event generating a gain under the relevant item, the amount of the gain is equal to: