Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsUse the following method statement to work out the uplift in * adjustable value of an * up interest under:

(a) item 3, 4, 5 or 8 of the table in subsection 725 - 250(2); or

(b) item 2, 3, 6 or 9 of the table in subsection 725 - 335(3).

Method statement

Step 1. If the * market value of the * up interest increases because of the direct value shift, group together all * up interests of the kind referred to in the relevant item that sustained the same increase in market value as the up interest because of the direct value shift.

If the up interest is issued at a discount, group together all up interests of the kind referred to in the relevant item that are issued at a discount of the same amount as the up interest because of the direct value shift.

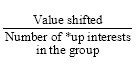

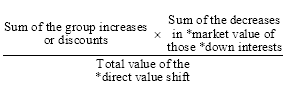

Step 2. The value shifted to that group of * up interests from the * down interests referred to in the relevant item is the amount worked out using the formula:

where:

sum of the group increases or discounts means (as appropriate):

(a) the sum of the increases in * market value of all * up interests in the group because of the * direct value shift; or

(b) the sum of the * discounts at which all * up interests in the group were issued because of the * direct value shift.

(a) if the sum of the decreases in * market value of all * down interests because of the * direct value shift is equal to or greater than the sum of the increases in market value of all * up interests and all * discounts given because of the shift--the sum of the decreases; or

(b) if the sum of the decreases in market value of all down interests because of the direct value shift is less than the sum of the increases in market value of all up interests and all discounts given because of the shift--the sum of the increases and discounts.

Step 3. The uplift in the * adjustable value of the * up interest under the relevant item is equal to: