Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) An * Australian corporate tax entity (the receiving entity ) has an amount that is not assessable income and is not * exempt income for an income year if:

(a) it receives from another Australian corporate tax entity a * frankable distribution that has an * unfranked part; and

(b) the * distribution statement for the * distribution declares an amount (a received CFI amount ) of the unfranked part to be * conduit foreign income; and

(c) the receiving entity, after the start of the income year but before the due day for lodging its * income tax return for that income year:

(i) makes a frankable distribution that has an unfranked part; and

(ii) declares an amount (a declared CFI amount ) of the unfranked part to be conduit foreign income.

(2) The amount that is not assessable income and is not * exempt income is the lesser of:

(a) the sum of the received CFI amounts that the receiving entity receives during the income year (the total received CFI amounts ); and

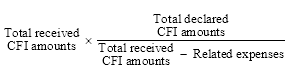

(b) the amount worked out using this formula:

where:

"related expenses" means the receiving entity's expenses that are reasonably related to the total received CFI amounts.

"total declared CFI amounts" means the sum of the declared CFI amounts in distributions made by the receiving entity before the due day for lodging its * income tax return for the income year.

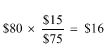

Example: AusCo 1 and AusCo 2 are both Australian corporate tax entities.

AusCo 1 pays an unfranked dividend of $80 to AusCo 2. AusCo 1 declares all of the $80 to be its conduit foreign income (so the $80 is a received CFI amount).

AusCo 2 has $5 of deductible expenses relating to the $80 dividend.

AusCo 2 pays an unfranked dividend of $30. AusCo 2 declares $15 of the $30 to be conduit foreign income (so the $15 is a declared CFI amount).

The amount that is not assessable income and is not exempt income for AusCo 2 (assuming there are no other received CFI amounts or declared CFI amounts) is:

The remaining $64 is included in AusCo 2's assessable income and it can deduct $4 (the part of the expenses related to the $64).

(3) If the receiving entity's expenses that are reasonably related to the total received CFI amounts equal or exceed the total received CFI amounts for an income year, the total received CFI amounts is not assessable income and is not * exempt income of the receiving entity for the income year.

(4) If a declared CFI amount is taken into account in working out an amount of * non - assessable non - exempt income of an entity for an income year, that amount cannot be taken into account for the entity for a later income year.

(5) Work out how much * conduit foreign income in a * frankable distribution flows through a trust or a partnership in the same way that you work out the * share of a * franking credit on a * franked distribution that flows through a trust or a partnership. That amount is treated as a received CFI amount under this section.

Note: See sections 207 - 50, 207 - 55 and 207 - 57 for the share of a franking credit on a franked distribution that flows through a trust or a partnership.