Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

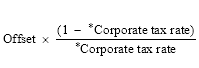

Commonwealth Consolidated ActsThe entity's conduit foreign income includes an amount if a tax offset arose for the entity under Division 770 for the income year immediately before the one in which the relevant time occurs. The amount is worked out using the formula: