Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) An * employment termination payment includes an invalidity segment if:

(a) the payment was made to a person because he or she stops being * gainfully employed; and

(b) the person stopped being gainfully employed because he or she suffered from ill - health (whether physical or mental); and

(c) the gainful employment stopped before the person's * last retirement day; and

(d) 2 legally qualified medical practitioners have certified that, because of the ill - health, it is unlikely that the person can ever be gainfully employed in capacity for which he or she is reasonably qualified because of education, experience or training.

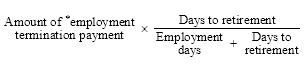

(2) Work out the amount of the invalidity segment by applying the following formula:

where:

"days to retirement" is the number of days from the day on which the person's employment was terminated to the * last retirement day.

"employment days" is the number of days of employment to which the payment relates.