Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The amount of the * imported hybrid mismatch is the lesser of:

(a) the importing deduction amount worked out under subsection (2) in relation to the deduction; and

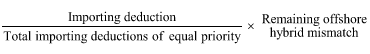

(b) the amount worked out using the following formula:

where:

"importing deduction" means the amount of the importing deduction amount worked out under subsection (2) in relation to the deduction.

"remaining offshore hybrid mismatch" means:

(a) unless paragraph (b) applies--the amount of the * offshore hybrid mismatch; or

(b) if an item higher in the table in subsection 832 - 615(2) applies to one or more other * importing payments in relation to the offshore hybrid mismatch--the amount of the offshore hybrid mismatch that is not, or will not be, neutralised by the application of this Subdivision, and equivalent provisions of applicable * foreign hybrid mismatch rules, in relation to those other importing payments.

"total importing deductions of equal priority" means the amount worked out by:

(a) identifying each * importing payment in relation to the * offshore hybrid mismatch to which the same item in the table in subsection 832 - 615(2) applies; and

(b) working out under subsection (2) the importing deduction amount in relation to the deduction or * foreign income tax deduction to which each such importing payment gives rise; and

(c) summing the results from paragraph (b) for each such importing payment.

(2) The amount (the importing deduction amount ) worked out under this subsection in relation to a deduction or * foreign income tax deduction is:

(a) if the * importing payment is made directly to the offshore deducting entity--the amount of the deduction or foreign income tax deduction; or

(b) if the importing payment is made indirectly through one or more interposed entities to the offshore deducting entity--the lesser of:

(i) the amount of the deduction or foreign income tax deduction; and

(ii) the smallest amount of any foreign income tax deduction to which a payment by an interposed entity gave rise.