Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a * CGT asset that is * taxable Australian property under item 3 of the table in section 855 - 15 because you have used it at any time in carrying on a * business through a permanent establishment (as mentioned in that item) in Australia.

(2) The * capital gain or * capital loss you make from a * CGT event in relation to the asset is reduced if you used it in this way for only part of the period from when you * acquired it to when the CGT event happened.

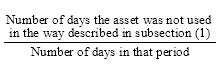

(3) The gain or loss is reduced by this fraction: