Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

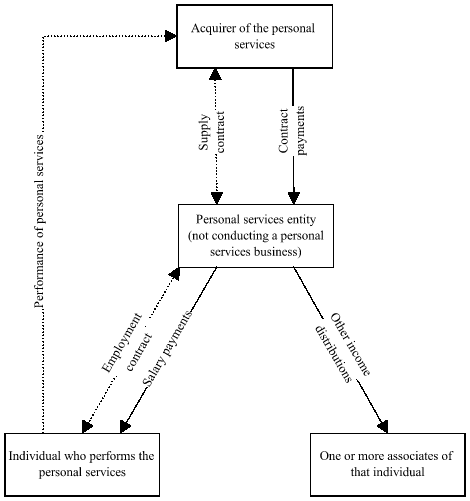

Commonwealth Consolidated Acts(1) This diagram shows an example of a simple arrangement for the alienation of personal services income.

Note 1: Solid lines indicate actual payments between the parties. Dotted lines indicate other interactions between the parties.

Note 2: This Division also applies to different and more complex arrangements.

(2) This Division has the effect of attributing the personal services entity's income from the personal services to the individual who performed them (unless the income is promptly paid to the individual as salary). Certain deduction entitlements of the personal services entity can reduce the amount of the attribution.

Table of sections

86 - 10 Object of this Division

86 - 15 Effect of obtaining personal services income through a personal services entity

86 - 20 Offsetting the personal services entity's deductions against personal services income

86 - 25 Apportionment of entity maintenance deductions among several individuals

86 - 27 Deduction for net personal services income loss

86 - 30 Assessable income etc. of the personal services entity

86 - 35 Later payments of, or entitlements to, personal services income to be disregarded for income tax purposes

86 - 40 Salary payments shortly after an income year