Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

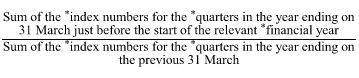

Commonwealth Consolidated Acts(1) For indexation of amounts on an annual basis, the indexation factor is:

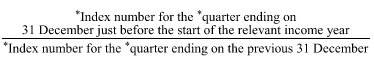

(1A) However, for indexation of the amounts mentioned in the provisions listed at items 5, 6 and 7 in section 960 - 265, the indexation factor is:

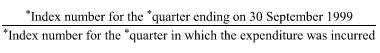

(2) For indexation of the * cost base of a * CGT asset (except the first element of the cost base of an asset covered by subsection (3)), the indexation factor for expenditure in an element of the cost base is:

The expenditure can include giving property: see section 103 - 5.

Note 1: This rule does not apply to expenditure incurred after 11.45 am on 21 September 1999 or any expenditure relating to a CGT asset acquired after that time: see section 114 - 1.

Note 2: This rule applies even if you do not actually pay some of the expenditure until a later time (for example, under a contract to purchase an asset by instalments).

Note 3: There are rules affecting when the expenditure was incurred: see sections 114 - 15 and 114 - 20.

(3) For indexation of the first element of the * cost base of a * CGT asset that is:

(a) a * share in a company; or

(b) a unit in a unit trust;

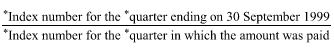

the indexation factor for an amount in the first element of the * cost base of the asset that was paid to the company or trust at a time after it was * acquired is:

The payment can include giving property: see section 103 - 5.

Example: Peter acquires shares in a company. The shares are partly - paid, and the company makes a call on the shares. Peter sells the shares to Narina before he is liable to pay the call.

The amount Narina paid to Peter for the shares is indexed under subsection 960 - 275(2) from the quarter in which she incurred the expenditure to acquire the shares.

The amount Narina later pays for the call on the shares is indexed in accordance with subsection 960 - 275(3) from the quarter in which she made that later payment.

Note 1: This subsection does not apply to shares or units you acquired before 16 August 1989: see section 960 - 275 of the Income Tax (Transitional Provisions) Act 1997 .

Note 2: This subsection does not apply to an amount paid after 11.45 am on 21 September 1999 or an amount paid in relation to a CGT asset acquired after that time: see section 114 - 1.

(4) However, you cannot index expenditure in the third element of the * cost base of a CGT asset (costs of ownership).

(5) You work out the * indexation factor to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

Example: If the factor is 1.102795, it would be rounded up to 1.103.

(6) This section does not apply in relation to amounts mentioned in the provisions listed at items 8 to 12, or at item 14, in section 960 - 265.

Note: For the indexation of those amounts, see sections 960 - 285 and 960 - 290.