Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

A New Tax System (Australian Business Number) Act 1999

1 Section 5 (heading)

Repeal the heading, substitute:

5 Application to government entities, non - profit sub - entities and superannuation funds

2 Section 5

Omit ", or a * non - profit sub - entity,", substitute ", a * non - profit sub - entity or a * superannuation fund".

After "all", insert "or most of".

2B Subsection 38(3) (added by the A New Tax System (Indirect Tax and Consequential Amendments) Act (No. 2) 1999 )

Repeal the subsection, insert (after subsection (2)):

(2A) For the avoidance of doubt, the fact that activities of an entity are limited to making supplies to members of the entity does not prevent those activities:

(a) being in the form of a * business within the meaning of paragraph (1)(a); or

(b) being in the form of an adventure or concern in the nature of trade within the meaning of paragraph (1)(b).

Note: In addition to making other changes, item 2B corrects the incorrect numbering and location of this subsection by the A New Tax System (Indirect Tax and Consequential Amendments) Act (No. 2) 1999 .

A New Tax System (Goods and Services Tax) Act 1999

3 After subsection 9 - 10(3)

Insert:

(3A) For the avoidance of doubt, the delivery of:

(a) livestock for slaughtering or processing into * food; or

(b) game for processing into * food;

under an arrangement under which the entity making the delivery only relinquishes title after food has been produced, is the supply of the livestock or game (regardless of when the entity relinquishes title). The supply does not take place on or after the subsequent relinquishment of title.

3A Subsection 9 - 15(2B)

Omit "a body" (wherever occurring), substitute "an entity".

3B After paragraph 9 - 20(1)(d)

Insert:

(da) by a trustee of a * complying superannuation fund or, if there is no trustee of the fund, by a person who manages the fund; or

3C Paragraph 9 - 20(2)(c)

After "all", insert "or most of".

3D Subsection 9 - 20(3)

Repeal the subsection, insert (after subsection (2)):

(3) For the avoidance of doubt, the fact that activities of an entity are limited to making supplies to members of the entity does not prevent those activities:

(a) being in the form of a * business within the meaning of paragraph (1)(a); or

(b) being in the form of an adventure or concern in the nature of trade within the meaning of paragraph (1)(b).

Note: In addition to making other changes, item 3D corrects the incorrect location of this subsection by the A New Tax System (Indirect Tax and Consequential Amendments) Act (No. 2) 1999 .

4 Subsection 9 - 30(4)

After "anything", insert "(other than * new residential premises)".

4A Section 9 - 80

Omit "(worked out as if it were solely a taxable supply)".

4B At the end of section 9 - 80

Add:

(2) The value of the actual supply, for the purposes of subsection (1), is as follows:

where:

"taxable proportion" is the proportion of the value of the actual supply that represents the value of the * taxable supply (expressed as a number between 0 and 1).

4C Section 15 - 99 (after table item 2)

Insert:

2AA | Importations without entry for home consumption | Division 114 |

4D Section 17 - 99 (after table item 4)

Insert:

4A | Distributions from deceased estates | Division 139 |

4E Section 29 - 39 (after table item 8)

Insert:

8A | Distributions from deceased estates | Division 139 |

5 At the end of subsection 29 - 75(2)

Add:

(3) However, in circumstances that the Commissioner determines in writing, paragraph (2)(b) has effect as if the number of days referred to in that paragraph is the number of days specified in the determination in relation to those circumstances.

(4) Those circumstances may, for example, include the kind of the * taxable supply.

6 Subsection 29 - 80(2)

Omit "that relates to a * taxable supply the * value of which", substitute "of an amount that".

6A Section 37 - 1 (after table item 10)

Insert:

10A | Distributions from deceased estates | Division 139 |

7 Subsection 40 - 65(2)

Repeal the subsection, substitute:

(2) However, the sale is not input taxed to the extent that the * residential premises are:

(a) * commercial residential premises; or

(b) * new residential premises other than those used for residential accommodation before 2 December 1998.

8 Subsection 40 - 70(2)

Repeal the subsection, substitute:

(2) However, the supply is not input taxed to the extent that the * residential premises are:

(a) * commercial residential premises; or

(b) * new residential premises other than those used for residential accommodation before 2 December 1998.

8A Subsection 42 - 5(1B)

Repeal the subsection.

8B At the end of Division 42

Add:

42 - 10 Goods returned to Australia in an unaltered condition

An importation of goods is a non - taxable importation if:

(a) the goods were exported from Australia and are returned to Australia, without having been subject to any treatment, industrial processing, repair, renovation, alteration or any other process since their export; and

(b) the importer was not entitled to, and did not claim, a payment under Division 168 (about the tourist refund scheme) related to the export of the goods; and

(c) the importer:

(i) is the manufacturer of the goods; or

(ii) has previously acquired the goods, and the supply by means of which the importer acquired the goods was a * taxable supply (or would have been a taxable supply but for section 66 - 45); or

(iii) has previously imported the goods, and the previous importation was a * taxable importation in respect of which the GST was paid.

Note: An importation covered by this section may also be duty - free under item 17 of Schedule 4 to the Customs Tariff Act 1995 .

9 Subparagraph 48 - 10(1)(a)(ii)

Omit "or trust", substitute ", trust or individual".

10 After subsection 66 - 17(2)

Insert:

(2A) Subsection 29 - 10(3) does not apply to a * creditable acquisition of * second - hand goods if:

(a) the supply to which the acquisition relates is not a * taxable supply; and

(b) the amount that would have been the * value of the supply (if it had been a * taxable supply) does not exceed $50, or such higher amount as the regulations made for the purposes of subsection 29 - 80(1) specify.

(2B) Subsection 29 - 20(3) does not apply to a * decreasing adjustment relating to a * creditable acquisition of * second - hand goods if:

(a) the supply to which the acquisition relates is not a * taxable supply; and

(b) the amount of the adjustment does not exceed $50, or such higher amount as the regulations made for the purposes of subsection 29 - 80(2) specify.

10A After subsection 69 - 10(1)

Insert:

(1A) However, this section does not apply in relation to the acquisition or importation of:

(a) a commercial vehicle that is not designed for the principal purpose of carrying passengers; or

(b) a motor home or campervan.

11 After section 72 - 70

Insert:

Subdivision 72 - D -- Application of this Division to certain sub - entities

This Division applies to a * GST branch of an entity as if the GST branch were an * associate of:

(a) that entity; and

(b) every other GST branch of that entity; and

(c) any other associate of that entity.

72 - 95 Commonwealth government entities

This Division applies to a * government entity that is:

(a) a Department of State of the Commonwealth; or

(b) a Department of the Parliament; or

(c) an Executive Agency, or Statutory Agency, within the meaning of the Public Service Act 1999 ; or

(d) an organisation, established by the Commonwealth, of a kind referred to in paragraph (e) of the definition of government entity in section 41 of the A New Tax System (Australian Business Number) Act 1999 ;

as if the government entity were an * associate of the Commonwealth, of every other government entity of a kind referred to in paragraph (a), (b), (c) or (d) and of any other associate of the Commonwealth.

72 - 100 State or Territory government entities

This Division applies to a * government entity that is:

(a) a Department of State of a State or Territory; or

(b) an organisation, established by a State or Territory, of a kind referred to in paragraph (e) of the definition of government entity in section 41 of the A New Tax System (Australian Business Number) Act 1999 ;

as if the government entity were an * associate of:

(c) that State or Territory; and

(d) every other Department of State of that State or Territory, or organisation, established by that State or Territory, of a kind referred to in paragraph (e) of that definition; and

(e) any other associate of that State or Territory.

11AA At the end of section 84 - 15

Add:

(2) If the transfer is a transfer of the services of an employee, this section does not apply to the transfer to the extent that any payments that:

(a) are made from the * enterprise in Australia to the enterprise outside Australia; and

(b) relate to the transfer;

would be * withholding payments if they were payments from the enterprise in Australia to the employee.

11A After subsection 111 - 5(3)

Insert:

(3A) If you are a * partnership, this section does not apply to your reimbursement of a partner for an expense he or she incurs if, even without this Division applying, you are entitled to an input tax credit arising from the incurring of the expense.

11B At the end of Division 111

Add:

111 - 25 Employers paying work - related expenses of employees

If you make, or are liable to make, a payment on behalf of your employee for an expense that he or she incurs that is related directly to his or her activities as your employee, this Division applies to you as if you reimbursed your employee for the expense.

11C At the end of section 114 - 1

Add "An entity that enters for home consumption warehoused goods imported by someone else is entitled to any input tax credit for the importation.".

11D At the end of Division 114

Add:

114 - 25 Warehoused goods entered for home consumption by an entity other than the importer

(1) If you enter for home consumption (within the meaning of the Customs Act 1901 ) goods that are warehoused goods (within the meaning of that Act) and that were imported by another person:

(a) you are treated, for the purposes of Division 15, as having imported the goods; and

(b) the extent (if any) to which you entered the goods for home consumption for a * creditable purpose is treated as the extent (if any) to which you imported the goods for a creditable purpose.

(2) This section has effect despite Division 15 (which is about creditable importations).

11E At the end of section 129 - 25

Add:

(3) This section does not apply to a disposal if this Division continues to apply to the acquisition or importation of the thing because of subsection 138 - 17(2).

11F After section 138 - 15

Insert:

138 - 17 Situations to which this Division does not apply

(1) This Division does not apply to anything included in the assets of an entity whose * registration is cancelled, to the extent that the thing relates to an * enterprise that the entity * carried on before the cancellation, if:

(a) the cancellation arises as a result of the death of the entity, and the executor or trustee of the deceased estate:

(i) is registered or is * required to be registered; and

(ii) continues, immediately after the cancellation, to carry on that enterprise; or

(b) the cancellation arises as a result of the executor or trustee of a deceased estate ceasing to carry on any enterprise, and one or more beneficiaries of the deceased estate:

(i) are registered or is * required to be registered; and

(ii) continue, immediately after the cancellation, to carry on the enterprise that the deceased had carried on.

(2) Division 129 (which is about changes in the extent of creditable purpose) continues to apply to the acquisition or importation of the thing immediately after the cancellation if:

(a) Subdivision 129 - A does not prevent an adjustment arising under that Division for the acquisition or importation; and

(b) the cancellation occurs during an * adjustment period for the acquisition or importation.

(3) For the purposes of applying Division 129 to the acquisition or importation after the cancellation:

(a) the entity * carrying on the * enterprise in question immediately after the cancellation is taken to have made the acquisition or importation at the time it was originally made; and

(b) the extent (if any) to which the thing was originally acquired or imported for a * creditable purpose is taken to be the extent (if any) to which the entity acquired or imported the thing for a creditable purpose; and

(c) any * application of the thing since the original acquisition or importation is taken to be an application of the thing by the entity.

11G Section 138 - 20

After "This Division", insert "(except subsections 138 - 17(2)and (3))".

11H After Division 138

Insert:

Division 139 --Distributions from deceased estates

139 - 1 What this Division is about

Distributions from deceased estates, for private consumption, that are not taxable supplies may involve disposing of assets that were acquired or imported in circumstances giving rise to entitlements to input tax credits. This Division provides for an increasing adjustment to cancel those input tax credits.

139 - 5 Adjustments for distributions from deceased estates

(1) You have an increasing adjustment if:

(a) you are the executor or trustee of a deceased estate; and

(b) you are * registered or * required to be registered; and

(c) you supply an asset of the deceased estate to a beneficiary of the deceased estate; and

(d) the supply is not a * taxable supply and is not a supply that is * GST - free or * input taxed; and

(e) you were, or are, or the deceased person was, entitled to an input tax credit for the deceased person's acquisition or importation of the asset.

Note: Increasing adjustments increase your net amounts.

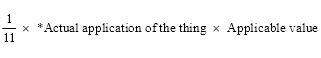

(2) The amount of the adjustment, for the asset, is as follows:

where:

"applicable value" is:

(a) the * GST inclusive market value of the asset immediately before it is supplied; or

(b) if you were, or are, or the deceased person was, entitled to an input tax credit for the deceased person acquiring the thing--the amount of the * consideration that you or the deceased person provided, or was liable to provide, for the acquisition of the thing, but only if the amount is less than that value; or

(c) if you were, or are, or the deceased person was, entitled to an input tax credit for the deceased person importing the thing--the cost to you or the deceased person of acquiring or producing the thing (plus the GST paid on its importation), but only if the amount is less than that value.

(3) However, an * adjustment does not arise under this section in respect of the asset if:

(a) the asset related to an * enterprise that the deceased person * carried on, and the beneficiary intends to continue to carry on that enterprise; or

(b) there were one or more * adjustment periods for the deceased person's acquisition or importation of the asset, and the last of those adjustment periods has ended before the cancellation of your * registration takes effect.

139 - 10 Attributing adjustments for distributions from deceased estates

(1) An * adjustment that you have under this Division is attributable to the tax period in which it arises.

(2) This section has effect despite section 29 - 20 (which is about attributing your adjustments).

139 - 15 Application of Division 129

This Division does not affect the operation of Division 129 (which is about changes in the extent of creditable purpose).

12 After section 188 - 30

Insert:

188 - 32 The value of gambling supplies

For the purposes only of this Division, the value of all the * gambling supplies that an entity makes during a particular period is taken to be an amount equal to 11 times:

(a) the entity's * global GST amount for that period; or

(b) if that period is not a tax period--what would have been the entity's global GST amount for the period if that period had been a tax period.

12A Section 195 - 1

Insert:

"complying superannuation fund" has the meaning given by section 995 - 1 of the * ITAA 1997.

12B Section 195 - 1 (after table item 8 of the definition of increasing adjustment )

Insert:

8A | Section 139 - 5 | Distributions from deceased estates |

13 Section 195 - 1 (definition of value , at the end of the note)

Add ", and section 188 - 32 contains a means of working out, for those purposes, the value of gambling supplies".

A New Tax System (Goods and Services Tax Transition) Act 1999

13A Section 5 (after table item 3)

Insert:

3AA | eligible short - term lease |

14 Before paragraph 11(1A)(b)

Insert:

(a) a supply to which section 12 applies; or

15 At the end of subsection 12(1)

Add:

Note: Section 11 does not apply to supplies covered by this section: see paragraph 11(1A)(a).

16 Subsection 15(2)

Repeal the subsection, substitute:

(2) If you entered into the agreement before 1 December 1999 and the funeral is provided on or after 1 July 2000, the supply is GST - free to the extent that the consideration for the supply is paid before 1 July 2005.

16A Subsection 20(1)

Omit "or importation", substitute "by way of purchase (including hire purchase), or importation,".

16B Paragraph 20(3A)(c)

Omit "subsection (2) or (3)", substitute "subsection (2), (3) or (4B)".

16C After subsection 20(4)

Insert:

(4A) Paragraph (4)(c) does not apply to a dealing in respect of the acquisition or importation if the acquisition or importation is made with the intention of granting an eligible short - term lease in respect of the motor vehicle, trailer or body.

(4B) Neither subsection (2) nor subsection (3) applies if you make the acquisition or importation before 1 July 2002 with the intention of granting an eligible short - term lease. However, the amount of any input tax credit you are entitled to on the acquisition or importation is reduced by an amount equal to:

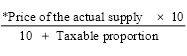

![]()

where:

"exempt percentage" is the exempt percentage specified in the agreement under subsection 15A(2) of the Sales Tax Assessment Act 1992 that applies to the eligible short - term lease in question.

"original input tax credit" is:

(a) if you make the acquisition or importation before 1 July 2001--the amount that would (but for this section) be the amount of the input tax credit on the acquisition or importation; or

(b) if you make the acquisition or importation on or after 1 July 2001 but before 1 July 2002--half that amount.

(4C) Agreements may be made under subsection 15A(2) of the Sales Tax Assessment Act 1992 , on or after 1 July 2000 but before 1 July 2002, as if:

(a) sales tax had not been ended by the A New Tax System (End of Sales Tax) Act 1999 and by section 8 of this Act; and

(b) the reference in subsection 15A(2) of the Sales Tax Assessment Act 1992 to a use of goods to satisfy one or more exemption Items were a reference to a use of goods that would have satisfied one or more exemption Items.

16D Subsection 20(6)

Omit "this section", substitute "subsection (3)".

16E At the end of section 20

Add:

(7) If an input tax credit to which you are entitled is reduced under subsection (4B), then, for the purposes of applying section 21 - 15 or 21 - 20 of the GST Act (where relevant), the amount of any adjustment under that section is reduced by the same proportion (before any application of Division 136 of that Act).

A New Tax System (Luxury Car Tax) Act 1999

16F At the end of subsection 25 - 1(2)

Add:

; or (c) a commercial vehicle that is not designed for the principal purpose of carrying passengers; or

(d) a motor home or campervan.

16G Subsection 71(2)

Omit "subsection (1)", substitute "paragraph 68(1)(d), (e), (f) or (i)".

16H At the end of section 132

Add:

(5) The rate of any import duty on goods:

(a) that are goods of a kind referred to in paragraph 68(1)(e); and

(b) whose owner is not required by section 71 to provide information about them;

is the rate of duty in force at the time when the goods arrive in Australia .

16I Subsection 132AA(1) (at the end of the table)

Add:

4 | Goods of a kind referred to in paragraph 68(1)(e) that are not covered by item 3 | Time of delivery of the goods into home consumption |

Taxation Administration Act 1953

17 After subsection 53(1)

Insert:

(1A) Subsection (1) does not apply to a member of a GST group if an Australian law has the effect of prohibiting the member from entering into any arrangement under which the member becomes subject to the liability referred to in that subsection.

(1B) However, a member to which subsection (1A) applies remains liable for any amount payable under an indirect tax law by the representative member of the group, to the extent that the liability arises from an act or omission of the member to which subsection (1A) applies.