Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

A New Tax System (Goods and Services Tax) Act 1999

1 Section 38 - 355 (table item 6, 3rd column, paragraph (b))

Repeal the paragraph, substitute:

(b) insuring the * international transport of goods from their * place of export in Australia to a destination outside Australia; or (c) insuring: (i) the transport of goods from a place outside Australia to their * place of consignment in Australia; and (ii) the subsequent transport of those goods within Australia, if it is an integral part of the transport of goods from the place outside Australia to the place of consignment in Australia; including loading and handling within Australia that is part of that transport; or (d) insuring the transport of goods from a place outside Australia to the same or another place outside Australia.

|

2 Subsection 78 - 15(4) (method statement)

Repeal the method statement, substitute:

Method statement

Step 1. Add together:

(a) the sum of the payments of * money (if any) made in settlement of the claim; and

(b) the * GST inclusive market value of the supplies (if any) made by the insurer in settlement of the claim (other than supplies that would have been * taxable supplies but for section 78 - 25).

Step 2. If any payments of excess were made to the insurer under the * insurance policy in question, subtract from the step 1 amount the sum of all those payments.

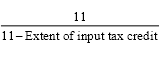

Step 3. Multiply the step 1 amount, or (if step 2 applies) the step 2 amount, by the following:

where:

extent of input tax credit has the meaning given by subsection (2).

3 Subparagraph 78 - 50(1)(c)(i)

Omit "the insurance policy was supplied", substitute "a claim was first made under the insurance policy since the last payment of a premium".

4 After paragraph 78 - 100(2)(c)

Insert:

(ca) those payments that that entity makes or is liable to make are treated as a premium it has paid; and

5 At the end of section 78 - 100

Add:

(3) However, if the entity treated as the entity insured:

(a) is liable to make payments referred to in paragraph (2)(c); and

(b) has not made all those payments;

for the purposes of sections 78 - 10 and 78 - 15, the entity's entitlement to an input tax credit for the premium paid is taken to be what its entitlement would have been if it had made all those payments.

A New Tax System (Goods and Services Tax Transition) Act 1999

6 After subsection 23(1)

Insert:

(1A) If, because of subsection (1), you are not entitled to an input tax credit for an acquisition you make, section 29 - 70 of the GST Act (which is about tax invoices) does not apply in relation to the supply to which the acquisition relates.

7 Section 23A

Repeal the section.