Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Where:

(a) the trustee of a resident trust estate is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of the net income or a part of the net income of the trust estate;

(b) in the case of a trust estate of a deceased person, the deceased person died not less than 3 years before the end of the year of income; and

(c) that net income or that part of the net income of the trust estate does not exceed $416;

no tax is payable under subsection 12(6) in respect of that net income or that part of the net income, as the case may be.

(2) Where:

(a) the trustee of a resident trust estate is liable to be assessed and to pay tax under section 99 of the Assessment Act in respect of the net income or a part of the net income of the trust estate;

(b) in the case of a trust estate of a deceased person, the deceased person died not less than 3 years before the end of the year of income; and

(c) that net income or that part of the net income of the trust estate exceeds $416 but does not exceed the net income phase - out limit;

the amount of tax payable by the trustee under subsection 12(6) in respect of that net income or that part of the net income shall not exceed 50% of the amount by which that net income or that part of the net income, as the case may be, exceeds $416, less any rebate or credit to which the trustee is entitled.

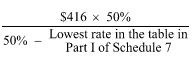

(3) The net income phase - out limit is the following amount rounded down to the nearest dollar: