Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A medical indemnity insurer's premium income for a period is the sum of all of the premiums paid during the period to the insurer for medical indemnity cover provided for medical practitioners by contracts of insurance with the insurer, and includes:

(a) the sum of all amounts that:

(i) were paid to the insurer during the period under one or more schemes under subsection 43(1) of the Medical Indemnity Act 2002 ; and

(ii) were payments of a kind referred to in paragraph 43(1)(a) of that Act; and

(b) the sum of all amounts paid to the insurer during the period that are amounts of a kind specified in the regulations for the purposes of this subsection.

(2) However, the amount of a medical indemnity insurer's premium income for a period under subsection ( 1) is reduced by:

(a) any amount of GST payable during the period for any supply made by the insurer for which premiums and other amounts referred to in subsection ( 1) are consideration; and

(b) the sum of all amounts of stamp duty payable during the period, under a law of a State or Territory, in connection with medical indemnity cover, or contracts of insurance, referred to in subsection ( 1); and

(c) the sum of all amounts payable during the period that are amounts of a kind specified in the regulations for the purposes of this subsection ; and

(d) the amount worked out under subsection ( 2A).

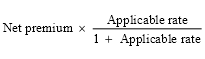

(2A) The amount referred to in paragraph ( 2)(d) is worked out as follows:

where:

"applicable rate" is the applicable percentage under subsection 6(2) for the insurer, expressed as a decimal fraction.

"net premium" is the sum of all the premiums referred to in subsection ( 1) reduced by the amounts referred to in paragraphs ( 2)(a), (b) and (c) in relation to those premiums.

(3) In this section:

"consideration" has the same meaning as in the A New Tax System (Goods and Services Tax) Act 1999 .

"GST" has the same meaning as in the A New Tax System (Goods and Services Tax) Act 1999 .

"medical indemnity cover" has the same meaning as in the Medical Indemnity Act 2002 .

"medical practitioner" has the same meaning as it has for the purposes of Division 2B of Part 2 of the Medical Indemnity Act 2002 .

Note: See subsections 4(1) and (6) of the Medical Indemnity Act 2002 .

"supply" has the same meaning as in the A New Tax System (Goods and Services Tax) Act 1999 .