Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

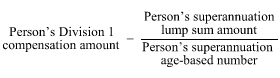

Commonwealth Consolidated Acts(1) If paragraph 89A(b) applies to a person, the amount of compensation that the Commonwealth is liable, under section 85, 86 or 87, to pay to the person for a week is worked out using the following formula:

(2) In this Division:

"superannuation age-based number" for a person who receives a lump sum under a Commonwealth superannuation scheme means the number that is advised by the Australian Government Actuary by reference to the person's age on the day on which the lump sum is paid.

"superannuation lump sum amount" for a person who receives a lump sum under a Commonwealth superannuation scheme means:

(a) if the scheme identifies a part of the lump sum as attributable to the contributions made under or to the scheme by the Commonwealth or a Commonwealth authority--the amount of that part; or

(b) in any other case, either:

(i) the amount assessed by the Commission to be the part of the lump sum that is attributable to the contributions made under or to the scheme by the Commonwealth or a Commonwealth authority; or

(ii) if such an assessment cannot be made--the amount of the lump sum.

Note: Subsection 116B(2) defines Division 1 compensation amount .