Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

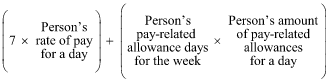

Commonwealth Consolidated Acts(1) The normal earnings for an incapacitated person for a week means the amount worked out using the following formula:

Note: The expressions used in this formula are defined in subsection (3).

(2) The Chief of the Defence Force must advise the Commission in writing of the date on which each compensable pay - related allowance would normally have ceased to be paid to the person if:

(a) the person were still a part - time Reservist; and

(b) the person were not incapacitated for service.

(3) In this section:

"amount of pay-related allowances" for an incapacitated person for a day means the total amount of compensable pay - related allowances that would have been paid to the person for the day as a part - time Reservist if:

(a) the person were still a part - time Reservist; and

(b) the person were not incapacitated for service.

Note: The person's pay - related allowances might be adjusted under Part 5.

"compensable pay-related allowance" for an incapacitated person means a pay - related allowance:

(a) that was being paid to the person immediately before the person last ceased to be a member of the Defence Force; or

(b) that the person would have been paid after completing his or her initial training, as mentioned in section 189.

"example period" for an incapacitated person is:

(a) the latest period of one year:

(i) during which the person was a part - time Reservist; and

(ii) ending before the person ceased to be a member of the Defence Force; or

(b) such other period that the Commission determines is reasonable.

"pay-related allowance days" for an incapacitated person for a week means the average number of days per week (if any) served each week during the example period for which the person was paid an amount of pay - related allowances.

"rate of pay" for an incapacitated person for a day means the rate of pay that the person would have been paid for the day as a part - time Reservist if:

(a) the person were still a part - time Reservist; and

(b) the person were not incapacitated for service.

Note: The person's rate of pay might be adjusted under Part 5.