Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A partner who receives a notice under section 235 may choose to convert 25%, 50%, 75% or 100% of the weekly amount to a lump sum.

(2) A partner who makes a choice cannot change it.

(3) The choice must be made in writing and must be given to the Commission within 2 years after the date on which the partner received the notice.

(4) The Commission may, either before or after the end of that period, extend the period within which the choice must be made if it considers there are special circumstances for doing so.

Amount of lump sum

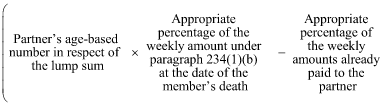

(5) The amount of the lump sum is worked out using the following formula:

where:

"appropriate percentage" means the percentage chosen by the partner under subsection (1).

"partner's age-based number" , in respect of a lump sum, means the number that is advised by the Australian Government Actuary by reference to the partner's age at the date of the member's death.

No lump sum for legal personal representative of a deceased partner

(6) The legal personal representative of a deceased partner is not entitled to choose to convert any percentage of the weekly amount that was payable to the deceased partner to a lump sum.

Effect on weekly payment of choosing a lump sum

(7) If a partner who receives a notice under section 235 chooses to convert 100% of the weekly amount to a lump sum, then, as soon as practicable after the choice is made, the weekly amount ceases to be payable to the partner.

(8) If a partner who receives a notice under section 235 chooses to convert 25%, 50% or 75% of the weekly amount to a lump sum, then, as soon as practicable after the choice is made, the weekly amount must be reduced accordingly.