Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

1 Paragraph 44 - 25(a)

Repeal the paragraph, substitute:

(a) either:

(i) a person is receiving a pension under Part II or IV of the Veterans' Entitlements Act 1986 at a rate determined under or by reference to subsection 30(1) of that Act; or

(ii) a person is receiving a weekly amount mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act 2004 , or would be receiving such a weekly amount if the person had not chosen to receive a lump sum under that paragraph; and

2 Paragraph 44 - 25(b)

After "pension", insert "or weekly amount".

3 Paragraph 44 - 25(c)

After "pension" (wherever occurring), insert "or weekly amount".

4 Paragraph 86 - 3(i)

After " Veterans' Entitlements Act 1986 ", insert "or Chapter 6 of the Military Rehabilitation and Compensation Act 2004 ".

5 Paragraph 86 - 6(a)

Omit "or section 130 of the Veterans' Entitlements Act 1986 ", substitute ", section 130 of the Veterans' Entitlements Act 1986 or section 409 of the Military Rehabilitation and Compensation Act 2004 ".

Note: The heading to section 86 - 6 is altered by omitting " or Veterans' Entitlements Act 1986 " and substituting " , Veterans' Entitlements Act 1986 or Military Rehabilitation and Compensation Act 2004 ".

6 Subsection 96 - 10(2)

Repeal the subsection, substitute:

(2) This section does not apply to any amount payable in respect of:

(a) treatment (within the meaning of Part V of the Veterans' Entitlements Act 1986 ) that the * Repatriation Commission has arranged under section 84 of that Act; or

(b) treatment (within the meaning of section 13 of the Military Rehabilitation and Compensation Act 2004 ) that the * Military Rehabilitation and Compensation Commission has arranged under Division 4 of Part 3 of Chapter 6 of that Act.

Note: Under the Veterans' Entitlements Act 1986 and the Military Rehabilitation and Compensation Act 2004 , the treatments that the * Repatriation Commission and the * Military Rehabilitation and Compensation Commission can arrange could include the provision of * aged care for which subsidy is payable under Chapter 3 of this Act.

7 Clause 1 of Schedule 1

Insert:

"Military Rehabilitation and Compensation Commission" means the Military Rehabilitation and Compensation Commission established under section 361 of the Military Rehabilitation and Compensation Act 2004 .

7A After paragraph 41(1)(f)

Insert:

(fa) the Military Rehabilitation and Compensation Act 2004 ; or

(fb) the Military Rehabilitation and Compensation (Consequential and Transitional Provisions) Act 2004 ; or

(fc) Part XI of the Safety, Rehabilitation and Compensation Act 1988 ; or

7B After subsection 41(2A)

Insert:

(2B) This Part does not make unlawful anything done by a person in direct compliance with a regulation, scheme or other instrument under the Military Rehabilitation and Compensation Act 2004 or the Military Rehabilitation and Compensation (Consequential and Transitional Provisions) Act 2004 .

A New Tax System (Family Assistance) Act 1999

8 After paragraph 7(h) of Schedule 3

Insert:

(ha) a Special Rate Disability Pension under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act 2004 ;

(hb) a payment of compensation under section 68, 71 or 75 of the Military Rehabilitation and Compensation Act 2004 ;

(hc) a payment of compensation mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act 2004 ;

A New Tax System (Family Assistance) (Administration) Act 1999

9 Paragraph 84(1)(b)

Omit "or the Veterans' Entitlements Act 1986 ", substitute ", the Veterans' Entitlements Act 1986 or the Military Rehabilitation and Compensation Act 2004 ".

10 Subparagraphs 84A(1)(b)(ii), 92(1)(a)(i) and 92A(1)(a)(i)

Omit "or the Veterans' Entitlements Act 1986 ", substitute ", the Veterans' Entitlements Act 1986 or the Military Rehabilitation and Compensation Act 2004 ".

A New Tax System (Medicare Levy Surcharge--Fringe Benefits) Act 1999

11 Subsection 13(2) (note)

Omit "under the Veterans' Entitlements Act 1986 ;", substitute "under the Veterans' Entitlements Act 1986 or the Military Rehabilitation and Compensation Act 2004 ;".

12 Subsection 14(2) (note)

Omit "under the Veterans' Entitlements Act 1986 ;", substitute "under the Veterans' Entitlements Act 1986 or the Military Rehabilitation and Compensation Act 2004 ;".

Data - matching Program (Assistance and Tax) Act 1990

13 Subsection 3(1) (after paragraph ( d) of the definition of personal assistance )

Insert:

(daa) any compensation or other benefit given under the Military Rehabilitation and Compensation Act 2004 ;

14 Subsection 120B(16) (definition of salary )

Omit " Commonwealth Employees' Rehabilitation and Compensation Act 1988 ", substitute " Safety, Rehabilitation and Compensation Act 1988 or the Military Rehabilitation and Compensation Act 2004 ".

Defence Force (Home Loans Assistance) Act 1990

15 Section 3 ( paragraph ( a) of the definition of compensable disability )

Omit " Commonwealth Employees' Rehabilitation and Compensation Act 1988 ", substitute " Safety, Rehabilitation and Compensation Act 1988 ".

16 Section 3 (after paragraph ( b) of the definition of compensable disability )

Insert:

(ba) the Military Rehabilitation and Compensation Act 2004 ; or

17 Subsection 24(4) ( subparagraph ( b)(i) of the definition of prescribed member )

Omit " Commonwealth Employees' Rehabilitation and Compensation Act 1989 ", substitute " Safety, Rehabilitation and Compensation Act 1988 ".

18 Subsection 24(4) (after subparagraph ( b)(i) of the definition of prescribed member )

Insert:

(ia) the Military Rehabilitation and Compensation Act 2004 ; or

Defence Reserve Service (Protection) Act 2001

19 Section 9

Repeal the section, substitute:

(1) In this Act:

"dependant" of a member who is or was rendering continuous full time service as a result of an order under section 50D, 51A, 51B or 51C of the Defence Act 1903 means:

(a) the member's partner; or

(b) a person who was wholly or partly dependent on the member for financial support immediately before the member's call out day; or

(c) a person who became, or becomes, wholly or partly dependent on the member for financial support while the member was or is rendering such service; or

(d) a person to whom:

(i) a pension is payable under the Veterans' Entitlements Act 1986 ; or

(ii) compensation is payable under the Military Rehabilitation and Compensation Act 2004 ;

because of the member's incapacity or death; or

(e) if the member died while rendering such service--the widow or widower of the member.

(2) In this section, the following expressions have the same meanings as in the Veterans' Entitlements Act 1986 :

(a) widow ;

(b) widower .

(3) In this section:

"partner" has the same meaning as in the Military Rehabilitation and Compensation Act 2004 .

Disability Discrimination Act 1992

20 At the end of subsection 51(1)

Add:

; or (h) the Military Rehabilitation and Compensation Act 2004 ; or

(i) the Military Rehabilitation and Compensation (Consequential and Transitional Provisions) Act 2004 ; or

(j) the Safety, Rehabilitation and Compensation Act 1988 so far as that Act applies to defence - related claims mentioned in Part XI of that Act.

Farm Household Support Act 1992

21 After subsection 12(4)

Insert:

(4A) Farm household support, exceptional circumstances relief payment or farm help income support is not payable to a person if the person is receiving a weekly amount mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act 2004 , or has received a lump sum mentioned in that paragraph.

Fringe Benefits Tax (Application to the Commonwealth) Act 1986

22 After paragraph 6AA(c)

Insert:

or (d) a person who has received a lump sum under Part 2 of Chapter 4 of the Military Rehabilitation and Compensation Act 2004 or who is receiving payments under that Part; or

(e) a person who is receiving a Special Rate Disability Pension under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act 2004 ;

23 Section 6AB

After "Entitlements Act", insert "or the Military Rehabilitation and Compensation Act 2004 ,".

Note: The heading to section 6AB is altered by adding at the end " and the Military Rehabilitation and Compensation Act ".

24 Subsection 3(1) (definition of prescribed non - resident )

Before "a pension," (first occurring), insert "compensation or".

25 Subsection 3(1) (after paragraph ( b) of the definition of prescribed non - resident )

Insert:

(ba) the Military Rehabilitation and Compensation Act 2004 ; or

26 Subsection 3(1) (definition of prescribed non - resident )

Before "a pension," (second occurring), insert "compensation or".

27 Subsection 16(1) (definition of eligible pensioner )

Before "a pension," (first occurring), insert "compensation or".

28 Subsection 16(1) (after paragraph ( b) of the definition of eligible pensioner )

Insert:

(ba) the Military Rehabilitation and Compensation Act 2004 ; or

29 Subsection 16(1) (definition of eligible pensioner )

Before "a pension," (second occurring), insert "compensation or".

30 Subsection 4(1) ( paragraph ( b) of the definition of Repatriation nursing home patient )

Repeal the paragraph, substitute:

(b) under section 285 of the Military Rehabilitation and Compensation Act 2004 .

31 Subsection 84(1) (after paragraph ( d) of the definition of concessional beneficiary )

Insert:

(da) a person who is:

(i) an Australian resident within the meaning of the Health Insurance Act 1973 ; and

(ii) entitled to treatment under section 284 of the Military Rehabilitation and Compensation Act 2004 ; or

32 Paragraph 84C(4A)(a)

Repeal the paragraph, substitute:

(a) the repatriation pharmaceutical benefit is supplied:

(i) under the scheme established under section 91 of the Veterans' Entitlements Act 1986 ; or

(ii) in accordance with a determination under paragraph 286(1)(c) of the Military Rehabilitation and Compensation Act 2004 ; and

Registration of Deaths Abroad Act 1984

33 Subsection 3(1) ( paragraph ( d) of the definition of prescribed person )

Omit " Repatriation Act 1920 ", substitute " Veterans' Entitlements Act 1986 ".

34 Subsection 3(1) (at the end of the definition of prescribed person )

Add:

; or (e) is receiving weekly amounts of compensation under the Military Rehabilitation and Compensation Act 2004 .

35 Subsection 4(1) (after paragraph ( c) of the definition of armed services widow )

Insert:

or (d) a person who was a member within the meaning of the Military Rehabilitation and Compensation Act for the purposes of that Act;

36 Subsection 4(1) (after paragraph ( c) of the definition of armed services widower )

Insert:

or (d) a person who was a member within the meaning of the Military Rehabilitation and Compensation Act for the purposes of that Act;

37 Subsection 5(1) (after paragraph ( e) of the definition of prescribed educational scheme )

Insert:

(ea) the scheme to provide education and training under section 258 of the Military Rehabilitation and Compensation Act; or

38 At the end of subsection 8(8)

Add:

; (zo) a payment under section 217 or 266 of the Military Rehabilitation and Compensation Act to reimburse costs incurred in respect of the provision of goods or services (other than a payment to the person who provided the goods or service);

(zp) if subsection 204(5) of the Military Rehabilitation and Compensation Act applies to a person--an amount per fortnight, worked out under subsection ( 12) of this section, that would, apart from this paragraph, be income of the person;

Note: Subsection 204(5) of the Military Rehabilitation and Compensation Act reduces a Special Rate Disability Pension by reference to amounts of Commonwealth superannuation that the person has received or is receiving.

(zq) a payment under the Motor Vehicle Compensation Scheme under section 212 of the Military Rehabilitation and Compensation Act;

(zr) a payment under section 242 of the Military Rehabilitation and Compensation Act (continuing permanent impairment and incapacity etc. payments).

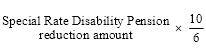

39 At the end of section 8

Add:

(12) For the purposes of paragraph 8(8)(zp), the amount per fortnight that is not income for the purposes of this Act is:

where:

"Special Rate Disability Pension reduction amount" means the amount by which the Special Rate Disability Pension (as reduced under subsection 204(3)) is reduced under subsection 204(6) of the Military Rehabilitation and Compensation Act (but not below zero).

40 After paragraph 10B(4)(c)

Insert:

(ca) a payment under the Military Rehabilitation and Compensation Act that is exempt from income tax under Subdivision 52 - CA of the Income Tax Assessment Act 1997 ; or

41 Subsection 23(1)

Insert:

" Military Rehabilitation and Compensation Act" or MRCA means the Military Rehabilitation and Compensation Act 2004 .

42 At the end of section 47

Add:

(7) An age pension is not payable to a person who:

(a) is an armed services widow or an armed services widower; and

(b) has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA; and

(c) is receiving income support supplement or would be eligible for income support supplement if he or she made a claim under section 45I of the VEA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA and VEA see subsection 23(1).

43 At the end of section 103

Add:

(7) A disability support pension is not payable to a person who:

(a) is an armed services widow or an armed services widower; and

(b) has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA; and

(c) is receiving income support supplement or would be eligible for income support supplement if he or she made a claim under section 45I of the VEA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA and VEA see subsection 23(1).

44 At the end of section 151

Add:

(7) A wife pension is not payable to a woman who:

(a) is an armed services widow; and

(b) has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA; and

(c) is receiving income support supplement or would be eligible for income support supplement if she made a claim under section 45I of the VEA.

Note 1: For armed services widow see subsection 4(1).

Note 2: For MRCA and VEA see subsection 23(1).

45 At the end of section 202

Add:

(7) A carer payment is not payable to a person who:

(a) is an armed services widow or an armed services widower; and

(b) has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA; and

(c) is receiving income support supplement or would be eligible for income support supplement if he or she made a claim under section 45I of the VEA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA and VEA see subsection 23(1).

46 At the end of section 500S

Add:

(5) Parenting payment is not payable to a person if:

(a) the person is an armed services widow or an armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

46A At the end of section 552

Add:

(3) Youth allowance is not payable to a person if:

(a) the person is an armed services widow or an armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

47 Section 573A

After "is receiving", insert "or has received".

48 Paragraph 573A(a)

Omit "or allowance", substitute ", allowance or compensation".

49 Section 573A (table heading)

Omit " and allowances ", substitute " , allowances and compensation ".

50 Section 573A (table column heading relating to Type of pension, benefit and allowance)

Omit " and allowance ", substitute " , allowance and compensation ".

51 Section 573A (after table item 4)

Insert:

4A | Compensation for an armed services widow or an armed services widower | (Paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act) |

51A At the end of section 578

Add:

(4) An austudy payment is not payable to a person if:

(a) the person is an armed services widow or an armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

52 After subsection 614(3A)

Insert:

(3B) A newstart allowance is not payable to a person if:

(a) the person is an armed services widow or armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

53 At the end of section 660YCF

Add:

(6) A mature age allowance is not payable to a person if:

(a) the person is an armed services widow or armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

54 After subsection 686(4)

Insert:

(4A) Sickness allowance is not payable to a person if:

(a) the person is an armed services widow or an armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

55 At the end of section 735

Add:

(5) Special benefit is not payable to a person if:

(a) the person is an armed services widow or an armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

56 At the end of section 771HI

Add:

(4) A partner allowance is not payable to a person if the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note: For MRCA see subsection 23(1).

57 At the end of section 787

Add:

(5) A special needs pension is not payable to a person if:

(a) the person is an armed services widow or an armed services widower; and

(b) the person has received a lump sum, or is receiving weekly amounts, mentioned in paragraph 234(1)(b) of the MRCA.

Note 1: For armed services widow and armed services widower see subsection 4(1).

Note 2: For MRCA see subsection 23(1).

58 After paragraph 1037(a)

Insert:

(aa) if the person is provided with a motor vehicle under the Motor Vehicle Compensation Scheme under section 212 of the MRCA--during any period during which the vehicle is provided; or

59 Section 1037 (note)

After " VEA ", insert "and MRCA ".

60 Subsection 1061JD(2) (definition of pharmaceutical allowance )

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

61 At the end of paragraph 1061PE(4)(e)

Add:

; or (vi) has received, or is entitled to receive, compensation for permanent impairment under section 68, 71 or 75 of the Military Rehabilitation and Compensation Act; or

(vii) is receiving a Special Rate Disability Pension under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act; or

(viii) is receiving, or has received, compensation mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act.

62 At the end of subsection 1061PJ(1)

Add:

; or (c) in the case of a person who has a dependent child--compensation under the Military Rehabilitation and Compensation Act set out in subsection ( 4).

63 At the end of section 1061PJ

Add:

Compensation under the Military Rehabilitation and Compensation Act

(4) For a person who has a dependent child, the compensation under the Military Rehabilitation and Compensation Act is the following:

(a) compensation for permanent impairment paid as a weekly amount under section 68, 71 or 75 of the Military Rehabilitation and Compensation Act;

(b) a Special Rate Disability Pension under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act;

(c) compensation of a weekly amount mentioned in subparagraph 234(1)(b)(ii) of the Military Rehabilitation and Compensation Act.

64 Before paragraph 1061R(b)

Insert:

(a) if the person is receiving a telephone allowance under the Military Rehabilitation and Compensation Act; or

65 Subsection 1061S(1) (table items 7 and 8)

After "VEA", insert "or MRCA".

66 After subsection 1064(6)

Insert:

(7) If:

(a) an armed services widow or an armed services widower has received a lump sum, or is receiving a weekly amount, mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act; and

(b) one of the following is payable to the widow or widower:

(i) an age pension;

(ii) a disability support pension;

(iii) a wife pension;

(iv) a carer payment;

(v) a mature age allowance under Part 2.12B;

(vi) disability wage supplement;

the rate of pension payable to the widow or widower is not to exceed $3,247.40.

Note: For armed services widow and armed services widower see subsection 4(1).

67 At the end of point 1064 - C2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1064 - C2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

68 Paragraph 1064 - C3(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1064 - C3 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

69 Point 1064 - C3 (at the end of the note)

Add "or is receiving pharmaceutical allowance under the MRCA".

70 Point 1064 - C7 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1064 - C7 is altered by inserting " and MRCA " after " VEA ".

71 After subsection 1065(5)

Insert:

Rate limited for certain armed services widows and widowers

(6) If:

(a) an armed services widow or an armed services widower has received a lump sum, or is receiving a weekly amount, mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act; and

(b) an age or disability support pension is payable to the widow or widower;

the rate of pension payable to the widow or widower is not to exceed $3,247.40.

Note: For armed services widow and armed services widower see subsection 4(1).

72 At the end of point 1065 - C2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1065 - C2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

73 Paragraph 1065 - C3(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1065 - C3 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

74 Point 1065 - C3 (at the end of the note)

Add "or is receiving pharmaceutical allowance under the MRCA".

75 Point 1065 - C7 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1065 - C7 is altered by inserting " and MRCA " after " VEA ".

76 At the end of point 1066 - C2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066 - C2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

77 Point 1066 - C6 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066 - C6 is altered by inserting " and MRCA " after " VEA ".

78 At the end of point 1066A - D2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066A - D2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

79 Paragraph 1066A - D3(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066A - D3 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

80 Point 1066A - D7 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066A - D7 is altered by inserting " and MRCA " after " VEA ".

81 At the end of point 1066B - D2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066B - D2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

82 Paragraph 1066B - D3(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066B - D3 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

83 Point 1066B - D7 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1066B - D7 is altered by inserting " and MRCA " after " VEA ".

84 Paragraph 1067G - C2(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1067G - C2 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

85 Paragraph 1067G - F3(a)

Omit "or allowance", substitute ", allowance or compensation".

86 Subparagraph 1067G - F23(a)(iii)

Omit "or allowance", substitute ", allowance or compensation".

87 Section 1067G (heading to Module L of the Youth Allowance Rate Calculator)

Omit " and allowances ", substitute " , allowances and compensation ".

88 Section 1067G (table heading in Module L of the Youth Allowance Rate Calculator)

Omit " and allowances ", substitute " , allowances and compensation ".

89 Section 1067G (table column heading relating to Type of pension, benefit and allowance in Module L of the Youth Allowance Rate Calculator)

Omit " and allowance ", substitute " , allowance and compensation ".

90 Section 1067G (after table item 4 in Module L of the Youth Allowance Rate Calculator)

Insert:

4A | Compensation for an armed services widow who has no dependent children | (Paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act) |

91 Section 1067G (after table item 20 in Module L of the Youth Allowance Rate Calculator)

Insert:

20A | Compensation for an armed services widow who has a dependent child | (Paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act) |

92 Paragraph 1067L - C2(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1067L - C2 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

93 At the end of point 1068 - D4

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068 - D4 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

94 Paragraph 1068 - D5(b)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068 - D5 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

95 Point 1068 - D9 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068 - D9 is altered by inserting " and MRCA " after " VEA ".

96 At the end of point 1068A - C2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068A - C2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

97 Point 1068A - C6 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068A - C6 is altered by inserting " and MRCA " after " VEA ".

98 At the end of point 1068B - E2

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068B - E2 is altered by adding at the end " or the Military Rehabilitation and Compensation Act ".

99 Paragraph 1068B - E3(a)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068B - E3 is altered by inserting " or the Military Rehabilitation and Compensation Act " after " Veterans' Entitlements Act ".

100 Point 1068B - E7 (at the end of the definition of pharmaceutical allowance )

Add "or the Military Rehabilitation and Compensation Act".

Note: The heading to point 1068B - E7 is altered by inserting " and MRCA " after " VEA ".

101 Point 1071A - 4 (at the end of paragraph ( e) of the definition of income )

Add ", including compensation within the meaning of the Military Rehabilitation and Compensation Act".

101A At the end of subsection 1130(3)

Add:

; and (e) any amounts that are not income of the person because of paragraph 8(8)(zp).

101B At the end of subsection 1130C(3)

Add:

; and (e) any amounts that are not income of the person because of paragraph 8(8)(zp).

101C At the end of subsection 1132(3)

Add:

; and (e) any amounts that are not income of the person because of paragraph 8(8)(zp).

102 Section 1190 (table items 55 and 56)

After " Veterans' Entitlements Act", insert "or the Military Rehabilitation and Compensation Act".

103 After paragraph 1228(2)(aa)

Insert:

(ab) a payment of compensation (within the meaning of the Military Rehabilitation and Compensation Act) under that Act; or

104 Subsection 1229A(1)

Repeal the subsection, substitute:

(1) This section applies to a person:

(a) who receives a further notice given under subsection 1229(3); and

(b) who:

(i) is not receiving a social security payment; and

(ii) is not receiving a payment of pension or allowance under the Veterans' Entitlements Act; and

(iii) is not receiving, and has not received, a payment of compensation (within the meaning of the Military Rehabilitation and Compensation Act) under that Act.

104A After paragraph 51(2)(d)

Insert:

(da) a period of leave of absence because of a service injury or disease (within the meaning of the Military Rehabilitation and Compensation Act 2004 ) in respect of which the person is receiving compensation under section 86 (part - time Reservists) or 127 (former member maintained in hospital) of that Act;

104B Section 54A (after paragraph ( a) of the definition of compensation leave )

Insert:

(aa) if the Military Rehabilitation and Compensation Act 2004 applies in relation to the eligible employee--compensation is payable under section 86 (part - time Reservists) or 127 (former member maintained in hospital) of that Act; or

104C At the end of section 54G

Add:

(2) If the request to the Board was made in relation to a condition in respect of which the eligible employee is entitled to receive compensation under the Military Rehabilitation and Compensation Act 2004 , the Board may, subject to subsection 54H(1), also ascertain the views of the Military Rehabilitation and Compensation Commission as to whether or not the employee be retired because he or she is totally and permanently incapacitated.

104D Subsection 54H(1)

After "a licensed administering authority", insert "or the views of the Military Rehabilitation and Compensation Commission".

104E Paragraph 54H(2)(a)

After "section 54G", insert "and any views given to the Board under that section".

104F After subsection 54JA(6)

Insert:

(6A) If the matter under consideration relates to a condition in respect of which the person is, or was, entitled to receive compensation under the Military Rehabilitation and Compensation Act 2004 , the Board may ascertain, in relation to that matter, the views of the Military Rehabilitation and Compensation Commission.

104G Subsection 78A(1)

After " Safety, Rehabilitation and Compensation Act 1988 ", insert "or the Military Rehabilitation and Compensation Act 2004 ".

Taxation Administration Act 1953

105 After paragraph 12 - 110(1)(b) in Schedule 1

Insert:

(ba) specified in an item of the table in section 52 - 114 of that Act (Military Rehabilitation and Compensation Act payments); or