Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

1 Subsection 8AAB(4) (after table item 19)

Insert:

19A | 50 - 15 | Minerals Resource Rent Tax Act 201 2 | payment of MRRT |

2 Subsection 8AAB(4) (after table item 45)

Insert:

45A | 115 - 30 in Schedule 1 | payment of MRRT instalments | |

45B | 115 - 65 in Schedule 1 | shortfall in MRRT instalments worked out on the basis of a varied rate |

3 At the end of section 11 - 1 in Schedule 1

Add:

; and (g) * MRRT.

4 Paragraphs 12 - 330(1)(b) and 12 - 335(2)(a) in Schedule 1

After " tax " , insert " or * MRRT " .

5 Subdivision 18 - A in Schedule 1 (heading)

Repeal the heading, substitute:

Subdivision 18 - A -- Crediting withheld amounts

6 At the end of section 18 - 10 in Schedule 1

Add:

(3) If an entity withholds an amount from a * withholding payment as required by section 12 - 325 (natural resource payments ), apply sections 18 - 15, 18 - 20 and 18 - 25 to the payment as if the entity had withheld only so much of that amount as was withheld in respect of tax.

Note: Section 18 - 49 provides a credit for amount s withheld in respect of MRRT.

7 Group heading before section 18 - 65 in Schedule 1

Repeal the heading, substitute:

Entitlement to credit: Minerals resource rent t a x

18 - 49 Credit--Natural resource payment s

(1) An entity is entitled to a credit in an * MRRT year if:

(a) one or more * withholding payments covered by section 12 - 325 (natural resource payment s ) from which there are * amounts withheld in respect of * MRRT are made to the entity during the MRRT year ; and

( b ) an assessment has been made of the MRRT payable, or an assessment has been made that no MRRT is payable, by the entity for the MRRT year.

(2) The amount of the credit is so much of the total of the * amounts withheld as is withheld in respect of * MRRT.

8 After Part 3 - 10 in Schedule 1

Insert:

Part 3 - 15 -- Minerals Resource Rent Tax

Table of Subdivisions

Guide to Division 115

115 - A Preliminary

115 - B Liability for instalments

115 - C Working out instalment amounts

115 - D Instalment rate chosen by you

115 - E Instalment rate given to you by Commissioner

115 - F Default instalment rate

115 - G Special rules for project interests that are transferred or split

115 - H Special rules for transitional accounting periods

115 - 1 What this Division is about

You pay quarterly instalments of MRRT under this Division if you have mining revenue for a quarter or a positive instalment rate.

Instalments give rise to a credit once an assessment of the MRRT is made.

The amount of a quarterly instalment is the product of your instalment income for the quarter and your applicable instalment rate.

The applicable instalment rate may be a rate chosen by you, a rate given to you by the Commissioner, or a statutory default rate.

General interest charge may be payable if a rate you choose for a quarter is too low, having regard to the amount of MRRT you are liable to pay for the year.

Subdivision 115 - A -- Preliminary

Table of sections

115 - 5 Objects of this Division

115 - 5 Objects of this Division

The objects of this Division are:

(a) to ensure the efficient collection of * MRRT by the payment of quarterly instalments; and

(b) to calculate total instalments for the * MRRT year that are as close as possible to the amount of MRRT you are liable to pay for the year .

Subdivision 115 - B -- Liability for instalments

Table of sections

115 - 10 Liability for instalments

115 - 15 Information to be given to the Commissioner

115 - 20 Credit for instalments payable

115 - 25 When instalments are due

115 - 30 General interest charge on late payment

115 - 10 Liability for instalments

(1) You are liable to pay an instalment under this Division in relation to an * instalment quarter in an * MRRT year, if:

(a) you have a * mining project interest or * hold a * pre - mining project interest ; and

(b) either:

(i) you have * mining revenue or * pre - mining revenue relating to the instalment quarter; or

(ii) your * applicable instalment rate for the instalment quarter is greater than nil.

Note 1: For provisions about collection and recovery of amounts you are liable to pa y under this Division, see Part 4 - 15 .

Note 2: For applicable instalment rate , see section 115 - 45 .

Meaning of instalment quarter

(2) For an * MRRT year (whether it ends on 30 June or not), the following are the instalment quarters :

(a) your first instalment quarter consists of the first 3 months of the MRRT year;

(b) your second instalment quarter consists of the fourth, fifth and sixth months of the MRRT year;

(c) your third instalment quarter consists of the seventh, eighth and ninth months of the MRRT year;

(d) your fourth instalment quarter consists of the tenth, 11th and 12th months of the MRRT year.

Note: There is a special rule for MRRT years that are not 12 months: see Subdivision 115 - H .

115 - 15 Information to be given to the Commissioner

(1) If you are liable to pay an instalment for an * instalment quarter (even if it is a nil amount), you must notify the Commissioner of the amount of your * instalment income for the quarter.

(2) You must notify the Commissioner in the * approved form and on or before the day when the instalment is due (regardless of whether it is paid).

(3) Subsection ( 1) does not apply to you for an * instalment quarter if:

(a) a nil rate determination under subsection 115 - 45 (2) or (3) applies to you for the quarter; and

(b) you are exempted from compliance with subsection ( 1) for the quarter:

(i) by a written notice the Commissioner gives you; or

(ii) by a legislative instrument that the Commissioner makes, exempting a class of entities.

(4) An exemption under subsection ( 3) may be combined in the same document as a nil rate determination.

115 - 20 Credit for instalments payable

(1) You are entitled to a credit when the Commissioner makes an assessment of the amount (including a nil amount) of * MRRT you are liable to pay.

(2) The amount of the credit is:

(a) the total of each instalment payable by you for the * MRRT year (even if you have not yet paid it); less

(b) the total of each credit that you have claimed under section 115 - 60 or 115 - 100 .

(3) The making of the assessment, and the resulting credit entitlement, do not affect the liability to pay an instalment.

Note: How the credit is applied is set out in Division 3 of Part IIB.

115 - 25 When instalments are due

An instalment you are liable to pay in relation to an * instalment quarter is due on or before the 21st day of the month after the end of that quarter.

115 - 30 General interest charge on late payment

If you fail to pay some or all of an instalment by the time by which the instalment is due to be paid, you are liable to pay the * general interest charge on the unpaid amount for each day in the period that:

(a) started at the beginning of the day by which the instalment was due to be paid; and

(b) finishes at the end of the last day on which, at the end of the day, any of the following remains unpaid:

(i) the instalment;

(ii) general interest charge on any of the instalment.

Subdivision 115 - C -- Working out instalment amounts

Table of sections

115 - 35 How to work out the amount of an instalment

115 - 40 Meaning of instalment income

115 - 45 Meaning of applicable instalment rate

115 - 35 How to work out the amount of an instalment

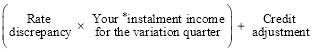

The amount of an instalment you are liable to pay in relation to * MRRT, in relation to an * instalment quarter, is:

![]()

115 - 40 Meaning of instalment income

Your instalment income for an * instalment quarter in an * MRRT year is the sum of the amounts worked out under column 2 of the table in subsection 30 - 25(2 ) of the Minerals Resource Rent Tax Act 201 2 for each * mining revenue event that:

(a) happens during the instalment quarter; and

(b) results in an amount (including a nil amount) being included :

(i) under section 30 - 1 0 of that Act in your * mining revenue for a * mining project interest for the MRRT year ; or

(ii) under section 70 - 40 of that Act in your * pre - mining revenue for a * pre - mining project interest for the MRRT year.

Note 1 : Special rules affect the calculation of instalment income for project interests that are transfe rred or split: see Subdivision 115 - G .

Note 2: If you have chosen to use the alternative valuation method under Division 175 of the Minerals Resource Rent Tax Act 201 2 , your unadjusted revenue amounts under section 175 - 30 of that Act will be the same as the amounts worked out under column 2 of the table in subsection 30 - 25(2) of that Act.

115 - 45 Meaning of applicable instalment rate

(1) Your applicable instalment rate , for an * instalment quarter in an * MRRT year (the current year ), is worked out using the first applicable item in the table.

Applicable instalment rate for an instalment quarter for MRRT | ||

Item | Column 1 If: | Column 2 Your applicable instalment rate is: |

1 | A nil rate determination under subsection ( 2) or (3) applies to you for the * instalment quarter | Nil. |

2 | You have chosen an ins talment rate under Subdivision 1 15 - D for: (a ) the * instalment quarter; or (b ) an earlier instalment quarter in the current year | The rate you chose for the instalment quarter, or, if you did not choose a rate for the instalment quarter, the rate you chose for the most recent earlier instalment quarter in the current year for which you chose a rate. |

3 | The Commissioner has given you an instal ment rate under Subdivision 115 - E before the end of the * instalment quarter (whether in the current year or an earlier * MRRT year) | The most recent instalment rate given to you by the Commissioner before the end of the instalment quarter. |

4 | None of items 1, 2 and 3 applies | The rate that ap plies to you under Subdivision 1 15 - F . |

Note: If you c hoose a rate under Subdivision 1 15 - D, you must use it for the rest of the MRRT year even if the Commissioner later gives you a different instalment rate.

Nil rate determinations

(2) The Commissioner may, by giving you written notice, determine a nil rate for you for an * MRRT year if, in the Commissioner ' s opinion, you are unlikely to be liable to pay * MRRT for the MRRT year.

(3) The Commissioner may, by legislative instrument, determine a nil rate for a class of entities for an * MRRT year if, in the Commissioner ' s opinion, each entity in the class is unlikely to be liable to pay * MRRT for the MRRT year.

(4) A determination applies for the * instalment quarter in which the Commissioner makes it, and for later quarters in the * MRRT year.

Note: The determination does not apply in later MRRT years.

(5) However, if the Commissioner later gives you an ins talment rate under Subdivision 115 - E, the determination stops applying to you for the instalment quarter in which you are given that later rate, and for later quarters.

Note 1: This may mean the nil rate determination does not apply to you for any instalment quarter (if the Commissioner makes the determination, then later in the same quarter gives you an ins talment rate under Subdivision 115 - E).

Note 2: For whether the rate the Commission er gives you under Subdivision 115 - E is your applicable instalment rate for an instalment quarter, see the table in subsection ( 1).

Subdivision 115 - D -- Instalment rate chosen by you

Table of sections

Choosing an instalment rate

115 - 50 Choosing a varied instalment rate

115 - 55 Notifying Commissioner of varied instalment rate

Variation credits

115 - 60 Credit on using varied rate in certain cases

General interest charge payable in certain cases if instalments are too low

115 - 65 Liability to GIC on shortfall in instalments worked out on the basis of varied rate

115 - 70 Working out your benchmark instalment rate

115 - 50 Choosing a varied instalment rate

You may choose an instalment rate for an * instalment quarter in an * MRRT year under this Subd ivision.

Note 1: If choosing a rate leads you to pay an instalment that is too low, you may be liable to general interest charge under section 115 - 65 .

Note 2: You would also use this rate for later instalment quarters in the MRRT year, unless you choose another rate for the later instalment quarter under this section (see section 115 - 45 ).

Note 3: Division 119 is about choices under the MRRT law.

115 - 55 Notifying Commissioner of varied instalment rate

(1) If you choose an instalment rate for an * instalment quarter under section 115 - 50 , you must notify the Commissioner of the rate.

(2) You must notify the Commissioner in the * approved form and on or before the day the instalment for the * instalment quarter is due (regardless of whether it is paid).

Note: The Commissioner may combine this approved form with the approved form for the notice you are required to give under section 115 - 15 : see subsection 388 - 50(2).

115 - 60 Credit on using varied rate in certain cases

(1) You are entitled to claim a credit if:

(a) you are liable to pay an instalment for an * instalment quarter (the current quarter ) in an * MRRT year; and

(b) the amount of your instalment for the current quarter is to be worked out using an instalment rate you chose under section 115 - 50 ; and

(c) that rate is lower than your * applicable instalment rate for the previous quarter in the same year; and

(d) the amount worked out using the method statement is greater than nil.

Method statement

Step 1. Add up the instalments you are liable to pay for the earlier * instalment quarters in the year (even if you have not yet paid all of them).

Step 2. Subtract from the step 1 amount each earlier credit that you have claimed under this section or section 115 - 100 in respect of the year.

Step 3. Multiply the total of your * instalment income for those earlier * instalment quarters by your * applicable instalment rate for the current quarter.

Step 4. Subtract the step 3 amount from the step 2 amount.

Step 5. If the result is a positive amount, it is the amount of the credit you can claim.

Example: In the first instalment quarter in an MRRT year, a miner has instalment income of $100m and an applicable instalment rate of 15%, which has been given by the Commissioner.

In the second instalment quarter in the MRRT year, the miner has instalment income of $80m and uses the same rate given by the Commissioner (15%).

In the third instalment quarter in the MRRT year, the miner has instalment income of $70m and chooses an instalment rate of 12%.

The miner uses the method statement to work out a credit as follows:

Step 1: The instalment of $15m for the first instalment quarter ($100m x 15%), plus the instalment of $12m for the second instalment quarter ($80m x 15%) gives a total step 1 amount of $27m.

Step 2: No earlier credits have been claimed, so there is no amount to subtract from the step 1 amount--the step 2 amount is $27m.

Step 3: The total of the instalment income for the earlier quarters is $180m, multiplied by the rate for the current quarter (12%), equals $21.6m.

Step 4: $27m - $21.6m = $5.4m.

Step 5: The miner has a credit of $5.4m.

The miner also has an instalment liability for the current quarter of $8.4m ($70m x 12%).

After applying the $5.4m credit, the miner will be liable to pay an amount of $3m for the quarter.

(2) A claim for a credit must be made in the * approved form on or before the day on which the instalment for the current quarter is due.

Note: How the credit is applied is set out in Division 3 of Part IIB.

(3) The credit entitlement does not affect your liability to pay an instalment.

General interest charge payable in certain cases if instalments are too l o w

115 - 65 Liability to GIC on shortfall in instalments worked out on the basis of varied rate

(1) You are liable to pay the * general interest charge under this section if:

(a) an instalment rate (the varied rate ) you choose under section 115 - 50 is your * applicable instalment rate for an * instalment quarter (the variation quarter ) in an * MRRT year; and

(b) the varied rate is less than 85% of your * benchmark instalment rate for the MRRT year.

Note: For the Commissioner ' s power to remit general interest charge, see section 8AAG.

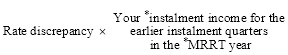

(2) You are liable to pay the * general interest charge on the amount worked out as follows:

where:

"credit adjustment" means:

(a) if, as a result of using the varied rate for the variation quarter, you claimed a credit under section 115 - 60 --the amount worked out as follows:

or the sum of the amounts of the credits, whichever is less; and

(b) otherwise--nil.

"rate discrepancy" means the difference between the varied rate and the lesser of:

(a) the rate that would have been your * applicable instalment rate for the variation quarter if you did not choose an instalment rate for the variation quarter or an earlier * instalment quarter in the * MRRT year; and

(b) your * benchmark instalment rate for that MRRT year.

(3) You are liable to pay the charge for each day in the period that:

(a) started at the beginning of the day by which the instalment for the variation quarter was due to be paid; and

(b) finishes at the end of the day on which your * assessed MRRT for the * MRRT year is due to be paid.

(4) The Commissioner must give you written notice of the * general interest charge to which you are liable under subsection ( 2). You must pay the charge within 14 days after the notice is given to you.

(5) If any of the * general interest charge to which you are liable under subsection ( 2) remains unpaid at the end of the 14 days referred to in subsection ( 4), you are also liable to pay the general interest charge on the unpaid amount for each day in the period that:

(a) starts at the end of those 14 days; and

(b) finishes at the end of the last day on which, at the end of the day, any of the following remains unpaid:

(i) the unpaid amount;

(ii) general interest charge on the unpaid amount.

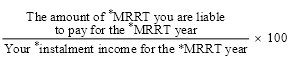

115 - 70 Working out your benchmark instalment rate

Your benchmark instalment rate for an * MRRT year is the percentage worked out to 2 decimal places (rounding up if the third decimal place is 5 or more) using the formula:

However, your benchmark instalment rate for the MRRT year is a nil rate if either component of the fraction is nil.

Subdivision 115 - E -- Instalment rate given to you by Commissioner

Table of sections

115 - 75 Commissioner instalment rate for MRRT

115 - 80 Commissioner may take changes, and proposed changes, to the law into account

115 - 75 Commissioner instalment rate for MRRT

(1) The Commissioner may give you an instalment rate from time to time, by giving you written notice of:

(a) the instalment rate; and

(b) the modified MRRT liability, as worked out under subsection ( 2), for the purposes of working out the instalment rate.

Note: For whether the rate the Commissioner gives you is your applicable instalment rate for an instalment quarter, see section 115 - 45 .

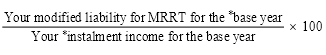

(2) An instalment rate that the Commissioner gives you must be the percentage worked out to 2 decimal places (rounding up if the third decimal place is 5 or more) using the formula:

where:

"modified" liability for MRRT is the amount of * MRRT you are liable to pay for the * base year, subject to section 115 - 80 .

Note: The instalment rate worked out under this subsection could exceed the MRRT rate. One reason for this is that not all amounts of mining revenue are included in instalment income.

(3) The base year is the most recent * MRRT year for which an assessment of * MRRT has been made for you.

(4) However, the instalment rate must be a nil rate if either component of the fraction is nil.

(5) Despite subsections ( 2) to (4), the Commissioner may give you an instalment rate worked out on a different basis if, having regard to the object of this Division and the circumstances, the Commissioner is of the opinion:

(a) that it would be reasonable to work out the rate under this subsection; and

(b) that the rate so worked out is reasonable.

Example: The following are s ome examples of circumstances in which a rate may be worked out on a different basis:

(a) an entity joins or leaves a consolidated group;

(b) a mining project interest is transferred or split;

(c) there is no base year for the mining project interest;

(d) there was a significant amount of one - off capital expenditure in the base year;

(e) MRRT allowances applied in a later year are expected to be significantly less than MRRT allowances applied in the base year;

(f) there is a change in the economic circumstances of the mining industry.

(6) To avoid doubt, an instalment rate the Commissioner works out under subsection ( 5) may be higher, or lower, than the rate worked out under subsection ( 2) (if a rate can be worked out under that subsection).

115 - 80 Commissioner may take changes, and proposed changes, to the law into account

For the purposes of working out your modified liability for * MRRT for a * base year, the Commissioner may work out an amount:

(a) as if provisions of an Act or regulations, as they may reasonably be expected to apply for the purposes of your assessment for a later * MRRT year, had applied for the purposes of the base year; and

(b) as if provisions of an Act or regulations had applied for the purposes of the base year if:

(i) in the Commissioner ' s opinion, the provisions are likely to be enacted or made; and

(ii) the application of the provisions reduces the instalment rate being given to you.

Note: Taking law changes, and proposed law changes, into account in working out the instalment rate means total instalments for the year are as close as possible to your likely MRRT for the year.

Subdivision 115 - F -- Default instalment rate

Table of sections

115 - 85 Default instalment rate

115 - 85 Default instalment rate

Instalment rate for instalment income relating to iron ore

(1) The rate that applies to you for an * instalment quarter in which your * instalment income only includes amounts relating to iron ore is:

(a) if paragraph ( b) does not apply-- 8 %; or

(b) if the regulations prescribe a rate for the instalment quarter for the purposes of this subsection--that rate.

Instalment rate for instalment income relating to other taxable resources

(2) The rate that applies to you for an * instalment quarter in which your * instalment income only includes amounts relating to * taxable resources other than iron ore, is:

(a) if paragraph ( b) does not apply-- 3 %; or

(b) if the regulations prescribe a rate for the instalment quarter for the purposes of this subsection--that rate.

Instalment rate for instalment income relating to iron ore and other taxable resources

(3) The rate that applies to you for an * instalment quarter in which your * instalment income includes amounts relating both to iron ore and to other * taxable resources is the sum of the following, worked out to 2 decimal places (rounding up if the third decimal place is 5 or more):

(a) the rate that would apply for the quarter if your instalment income only included amounts relating to iron ore, multiplied by the proportion of your total instalment income for the qu arter that relates to iron ore;

(b) the rate that would apply for the quarter if your instalment income only included amounts relating to taxable resources other than iron ore, multiplied by the proportion of your total instal ment income for the quarter that relates to taxable resources othe r than iron ore.

Example: In an instalment quarter, you have $200m in instalment income from mining project interests that relate to iron ore, and $100m in instalment income from mining project interests that relate to coal.

Under subsection ( 1), the default instalment rate for iron ore is 8 %, and under subsection ( 2) the defau lt instalment rate for coal is 3%.

The rate that applies to you for the quarter is 6.33 % [(. 08 x 200m/300m) + (. 0 3 x 100m/300m)].

Regulations not to be made in first MRRT year

(4) The regulations may prescribe a rate for the purposes of subsection ( 1) or (2) for an * instalment quarter in the 2013 - 2014 * MRRT year or a later year.

Subdivision 115 - G -- Special rules for project interests that are transferred or split

Table of sections

115 - 90 Effect of transfer or split of project interest on instalment income

115 - 95 Additional instalment income for new miner or new explorer

115 - 100 Credit for original miner or original explorer for instalment quarters before transfer or split

115 - 105 Adjusted instalment income for original miners or explorer s

115 - 90 Effect of transfer or split of project interest on instalment income

Instalment quarters that have ended before transfer or split happens--instalment income not affected by transfer or split

(1) In working out, under section 115 - 40, your * instalment income for an * instalment quarter that ends before a * mining project transfer, * mining project split, * pre - mining project transfer or * pre - mining project split h appens:

(a) include amounts that:

(i) relate to * mining revenue events that happen during the instalment quarter; and

(ii) would, apart from the application of Division 120, 125, 145 or 150 of the Minerals Resource Rent Tax Act 201 2 in relation to the transfer or split, be included in your * mining revenue or * pre - mining revenue as mentioned in section 115 - 40; and

(b) do not include amounts that:

(i) relate to mining revenue events that happen during the instalment quarter; and

(ii) are included in your mining revenue or pre - mining revenue as mentioned in section 115 - 40 only because of the application of those Divisions in relation to the transfer or split.

Note 1: For the original miner or explorer ( paragraph ( a) case):

(a) a credit may be available under section 115 - 100; and

(b) the effect of paragraph ( a) is modified in some circumstances: see section 115 - 105.

Note 2: For the new miner or explorer ( paragraph ( b) case), additional " catch up " instalment income may be included in the quarter in which the transfer or split happens: see section 115 - 95.

Instalment quarter in which transfer or split happens--instalment income transfers with interest

(2) In working out, under section 115 - 40, your * instalment income for an * instalment quarter in which a * mining project transfer, * mining project split, * pre - mining project transfer or * pre - mining project split happens:

(a) include amounts that:

(i) relate to * mining revenue events that happen during the instalment quarter; and

(ii) because of the application of Division 120, 125, 145 or 150 of the Minerals Resource Rent Tax Act 201 2 in relation to the transfer or split, are included in your * mining revenue or * pre - mining revenue as mentioned in section 115 - 40; and

(b) do not include amounts that:

(i) relate to mining revenue events that happen during the instalment quarter; and

(ii) because of the application of those Divisions in relation to the transfer or split, are not included in your mining revenue or pre - mining revenue as mentioned in section 115 - 40.

115 - 95 Additional instalment income for new miner or new explorer

(1) Your instalment income for an * instalment quarter in an * MRRT year includes an amount worked out under subsection ( 2) if:

(a) a * mining project transfer, * mining project split, * pre - mining project transfer or * pre - mining project split happens in the instalment quarter; and

(b) you have the relevant * mining project interest or * pre - mining project interest after the transfer or split.

(2) The amount is the sum of the amounts worked out under column 2 of the table in subsection 30 - 25(2) of the Minerals Resource Rent Tax Act 201 2 for each * mining revenue event that:

(a) happens before the start of the * instalment quarter in which the transfer or split happens; and

(b) because of the application of Division 120, 125, 145 or 150 of the Minerals Resource Rent Tax Act 201 2 in relation to the transfer or split, results in an amount (including a nil amount) being included in your * mining revenue or * pre - mining revenue as mentioned in section 115 - 40.

Note 1: The additional instalment income amount is nil if the transfer or split happens in the first quarter of an MRRT year, and the miner or explorer that has the interest before the transfer or split has the same MRRT year as each miner or explorer that has the interest after the transfer or split.

Note 2: For the instalment quarter in which the transfer or split happens, instalment income from before the transfer or split is included under subsection 115 - 90(2).

(1) You are entitled to claim a credit if:

(a) a * mining project transfer, * mining project split, * pre - mining project transfer or * pre - mining project split happens in relation to a * mining project interest or * pre - mining project interest in an * instalment quarter in an * MRRT year; and

(b) your * instalment income for an earlier instalment quarter in the MRRT year for which you are liable to pay an instalment includes one or more amounts relating to the mining project interest; and

(c) the amount worked out using the method statement is greater than nil.

Method statement

Step 1. Add up the instalments you are liable to pay for the earlier * instalment quarters in the year (even if you have not yet paid all of them).

Step 2. Subtract from the step 1 amount each earlier credit that you have claimed under this section or section 115 - 60 in respect of the year.

Step 3. For each earlier * instalment quarter in the year, work out your * instalment income under section 115 - 40 without including amounts that:

(a) relate to * mining revenue events that happen during the instalment quarter; and

(b) because of the application of Division 120, 125, 145 or 150 of the Minerals Resource Rent Tax Act 201 2 in relation to a transfer or split, are not included in your * mining revenue or * pre - mining revenue as mentioned in section 115 - 40.

Note: Step 3 effectively recalculates instalment income disregarding paragraph 115 - 90(1)(a).

Step 4. Multiply the step 3 amount by your * applicable instalment rate for that quarter.

Step 5. Sum the amounts worked out under step 4.

Step 6. Subtract the step 5 amount from the step 2 amount.

Step 7. If the result is a positive amount, it is the amount of the credit you can claim.

Claim to be made in approved form

(2) A claim for a credit must be made in the * approved form on or before the day on which the instalment for the current quarter is due.

115 - 105 Adjusted instalment income for original miners or explorer s

(1) Despite subsection 115 - 90(1), the provisions mentioned in subsection ( 2) have effect as if your * instalment income for an * instalment quarter that ends before a * mining project transfer, * mining project split, * pre - mining project transfer or * pre - mining project split happens did not include amounts that:

(a) relate to * mining revenue events that happen during the instalment quarter; and

(b) because of the application of Division 120, 125, 145 or 150 of the Minerals Resource Rent Tax Act 201 2 in relation to the transfer or split, are not included in your * mining revenue or * pre - mining revenue as mentioned in section 115 - 40.

Note: Subsection ( 1) effectively recalculates instalment income disregarding paragraph 115 - 90(1)(a).

(2) The provisions are:

(a) subsection 115 - 65(2) (about GIC on instalment shortfalls); and

(b) section 115 - 70 (about your benchmark instalment rate for an * MRRT year); and

(c) subsection 115 - 75(2) (about working out a Commissioner instalment rate).

Subdivision 115 - H -- Special rules for transitional accounting periods

Table of sections

115 - 110 Instalment quarters in transitional accounting periods

115 - 110 Instalment quarters in transitional accounting periods

(1) An * MRRT year that is a period longer than 12 months has the following instalment quarters in addition to the instalment quarters mentioned in subsection 115 - 10 (2):

(a) your fifth instalment quarter consists of the 13th, 14th and 15th months of the MRRT year;

(b) your sixth instalment quarter consists of the 16th, 17th and 18th months of the MRRT year;

(c) your seventh instalment quarter consists of the 19th, 20th and 21st months of the MRRT year;

(d) your eighth instalment quarter consists of the 22nd, 23rd and 24th months of the MRRT year.

(2) Despite subsection ( 1) and subsection 115 - 10 (2):

(a) you do not have any instalment quarters that begin after the end of an * MRRT year; and

(b) an instalment quarter that would otherwise end after the end of an MRRT year consists instead of the period from the start of the instalment quarter to the end of the MRRT year.

Note: You will only have an MRRT year that is not a 12 month period if you are moving from one accounting period to another: see Division 190 of the Minerals Resource Rent Tax Act 201 2 .

Division 117 -- MRRT returns and starting base returns

117 - 1 What this Division is about

You are obliged to give the Commissioner an MRRT return for each MRRT year in which you have a mining project interest or pre - mining project intere st , unless the Commissioner does not require you to lodge a return .

You are also obliged to give the Commissioner a starting base return for the first MRRT year.

Table of sections

Operative provisions

117 - 5 Who must give MRRT returns

117 - 10 The form and contents of MRRT returns

117 - 15 Additional MRRT returns

117 - 20 Starting base returns

117 - 25 Electronic lodgement of MRRT returns and starting base returns

117 - 30 MRRT returns and starting base returns treated as being duly made

117 - 5 Who must give MRRT returns

(1) If you have a * mining project interest, or * hold a * pre - mining project interest , during an * MRRT year, you must give the Commissioner an * MRRT return for that year that relates to all such interests.

(2) You must give the return whether or not you are liable to pay * MRRT for the * MRRT year.

(3) You must give your * MRRT return for the * MRRT year to the Commissioner:

(a) on or before the first day of the sixth month after the end of the year ; or

(b) within such further period as the Commissioner allows; or

(c) if you are a member of a class of entities for which the Commissioner has determined a period under paragraph ( 5)(a)--within that further period;

whichever is the latest.

Note: Section 286 - 75 provides an administrative penalty for breach of this subsection.

(4) Despite subsection ( 1), you are not required to give the Commissioner an * MRRT return for an * MRRT year if:

(a) you have made a valid choice under section 200 - 10 of the Minerals Resource Rent Tax Act 201 2 ( choos ing to use the simplified MRRT method) that has effect at the end of the year; or

(b) you are a member of a class of entities that the Commissioner has exempted from providing a return for that year under paragraph ( 5)(b).

(5) The Commissioner may, by legislative instrument , do either or both of the following:

(a) determine a further period within which a class of entities may provide an * MRRT return for an * MRRT year;

(b) exempt a class of entities from providing an MRRT return for an MRRT year.

117 - 10 The form and contents of MRRT returns

(1) Your * MRRT return for an * MRRT year must be in the * approved form.

(2) The * appro ved form for an * MRRT return m ust require information to be provided relating to the following:

(a) your * taxable m ining profit for the * MRRT year;

(b) your * MRRT payable for the MRRT year.

Note: If you have chosen the simplified MRRT method under Division 200 of the Minerals Resource Rent Tax Act 201 2 , both of these amounts will be zero.

117 - 15 Additional MRRT returns

(1) In addition to the * MRRT returns required under section 117 - 5 , you must gi ve the Commissioner:

(a) such further or fuller MRRT returns ; or

(b) such other MRRT returns for an * MRRT year or a specified period, whether or not you have given the Commissioner an MRRT return for the same period;

as the Commissioner directs you to give (including any MRRT return in your capacity as agent or trustee).

(2) The * approved form for a further or fuller * MRRT return m ay require information to be provided relating to:

(a) the * MRRT year to which the return relates; or

(b) one or more preceding MRRT years; or

(c) both the MRRT year to which the return relates, and one or more preceding MRRT years.

117 - 20 Starting base returns

(1) In addition to the * MRRT returns required under section 117 - 5 or 117 - 15, you must give the Commissioner a * starting base return for the first * MRRT year if you make a choice under section 8 5 - 5 of the Minerals Resource Rent Tax Act 201 2 .

(2) The * starting base return must relate to all * starting base assets (and all property or rights that are expected to be starting base assets after the time mentioned in subsection 80 - 25(2) of that Act ) that you * hold that relate t o th e mining project interest or * pre - mini ng project interest to which that choice relates.

(3) A * starting base return is not valid unless you give it to the Commissioner:

(a) on or before the first day of the sixth month after the end of the first * MRRT year of the entity that had the mining project interest, or * held the * pre - mining project interest, on 1 July 2012 ; or

(b) within such further per iod as the Commissioner allows.

(4) A * starting base return must be in the * approved form.

(5) The * approved form must require information to be provided relating to:

(a) the * base value of all * starting base asset s mentioned in subsection ( 2) for the first * MRRT year; or

(b) what would be the base value of any other property or right mentioned in that subsection for that year if it were a starting base asset.

117 - 25 Electronic lodgement of MRRT returns and starting base returns

You must * lodge electronically your * MRRT returns and * starting base returns , unless the Commissioner otherwise approves.

Note: Section 388 - 75 in this Schedule deals with signing returns.

117 - 30 MRRT returns and starting base returns treated as being duly made

An * MRRT return or * starting base return purporting to be made or signed by or on behalf of an entity is treated as having been duly made by the entity or with the entity ' s authority until the contrary is proved.

Division 1 19 -- Making choices

119 - 1 What this Division is about

A choice you make under the MRRT law must be made in accordance with the general rules in this Division (subject to any more specific rule in the MRRT law).

Table of sections

Operative provisions

119 - 5 Making choices

119 - 10 Choices are irrevocable

119 - 15 Division subject to more specific rules

(1) If a provision of the * MRRT law allows, or requires, you to make a choice about a matter, the choice is not valid unless you make it:

(a) no later than:

(i) if you are required to give the Commissioner an * MRRT return for the first * MRRT year in which the choice applies--the earlier of the day on which that obligation is met or the day on which that obligation falls due; or

(ii) otherwise--the last day in the period within which you would be required to give the Commissioner such a return if you were required to give the Commissioner such a return; or

(b) within a further time that the Commissioner allows.

(2) The way your * MRRT return for an * MRRT year is prepared is sufficient evidence of you making the choice.

(3) However, you must give the Commissioner notice of the choice in the * approved form if:

(a ) you are not required to give the Commissioner an * MRRT return for that MRRT year; or

(b ) the * MRRT law expressly requires you to give the choice to the Commissioner; or

(c ) the Commissioner requests you to do so.

119 - 10 Choices are irrevocable

A choice under the * MRRT law is irrevocable.

119 - 15 Division subject to more specific rules

This Division is subject to any specific rules in the * MRRT law outside this Division.

121 - 1 What this Division is about

If a mining project transfer, mining project split, pre - mining project transfer or pre - mining project split happens, the original entity must give the new entity all the information the new entity will need to satisfy its MRRT obligations in relation to the interest it has acquired.

Table of sections

Operative provisions

121 - 5 Object of this Division

121 - 10 Information notice for transfers and splits of mining and pre - mining project interests

121 - 12 Notice of rehabilitation expenditure

121 - 15 Substantiation requirement

121 - 5 Object of this Division

The object of this Division is to provide entities with access to the information necessary for them to comply with their obligations under the * MRRT law.

121 - 10 Information notice for transfers and splits of mining and pre - mining project interests

(1) An entity (the original entity ) must give another entity (the new entity ) a notice if:

(a) the original entity had a * mining project interest before a * mining project transfer or * mining project split, and the new entity has the interest , or part of the interest, after the transfer or split; or

(b) the original entity * h el d a * pre - mining project interest before a * pre - mining project transfer or * pre - mining project split, and the new entity h olds the interest , or part of the interest, after the transfer or split.

(2) The notice must contain:

(a) the amount of each * allowance component relating to the new entity ' s interest; and

(b) the information the original entity has that is necessary for the new entity to work out, for the * MRRT year in which the transfer or split happens or for later MRRT years:

(i) the * starting base losses for its interest ; and

(ii) the amounts that are included in the new entity's * mining revenue or * pre - mining revenue for its interest; and

(ii i ) the amounts that are included in the new entity's * mining expenditure or * pre - mining expenditure for its interest; and

(iv) the amount of a * rehabilitation tax offset for its interest; and

( c ) for a split--the new entity ' s * split percentage for its interest; and

(d ) the information the original entity has that is necessary for the new entity to work out the new entity ' s * instalment income for an * instalment quarter in the MRRT year in which the transfer or split happens.

(3) The original entity must also give the new entity a notice containing information about a thing mentioned in section 12 0 - 20 , 12 5 - 3 0 , 145 - 2 5 or 150 - 3 0 of the Minerals Resource Rent Tax Act 201 2 (events that happen after a transfer or split) in relation to the transfer or split.

(4) The original entity must give the notice:

(a) in writing, or in another form acceptable to the new entity; and

(b) for a notice under subsection ( 1)--within 60 days of the * mining project transfer, * mining project split, * pre - mining project transfer or * pre - mining project split; and

(c) for a notice under subsection ( 3)--within 60 days of the day on which the thing happens.

Note: Section 286 - 75 provides an administrative penalty for a breach of this section. A breach of this section may also be an offence under section 8C, and making a false or misleading statement when providing the information may be an offence under section 8K or 8N.

121 - 12 Notice of rehabilitation expenditure

(1) If:

(a) an amount of expenditure is incurred by a trustee or bondholder (the trustee ) out of an amount provided as secu rity as mentioned in subsection 35 - 70 (1) of the Minerals Resource Rent Tax Act 201 2 ; and

(b) the amount is for rehabilitation of an area that is the * project area for a * mining project interest the other entity has at the time the amount is incurred;

the trustee must give the other entity a notice containing the information the trustee has that is necessary for the other entity to determine the extent, if any, to which the amount is * mining expenditure for the other entity.

(2) The trustee must give the notice:

(a) in writing, or in another form acceptable to the new entity; and

(b) within 60 days of the incurring of the amount.

Note: Section 286 - 75 provides an administrative penalty for a breach of this section. A breach of this section may also be an offence under section 8C, and making a false or misleading statement when providing the information may be an offence under section 8K or 8N.

121 - 15 Substantiation requirement

(1) An entity that receives information from another entity under this Division may request the other entity to provide further and better particular s of the information, including:

(a) if relevant, the underlying document or in formation on which it was based; and

(b) in relation to an amount, the way in which it was calculated .

(2) The other entity must comply with the request within 60 days of the request being made.

Note: Section 286 - 75 provides an administrative penalty for a breach of this section. A breach of this section may also be an offence under section 8C, and making a false or misleading statement when providing the information may be an offence under section 8K or 8N.

Division 123 -- Record keeping

123 - 1 What this Division is about

You are required to keep records relating to your mining operations or pre - mining operations in accordance with this Division.

Table of sections

Operative provisions

123 - 5 What records you must keep

123 - 10 Retaining records

123 - 15 Offence for failing to keep or retain records

123 - 5 What record s you must keep

(1) You must keep records of every act, transaction, event or circumstance relating to your * mining operations or * pre - mining operations that are relevant to working out any of the following:

(a) whether you are , or another entity is , liable to pay * MRRT for an * MRRT year;

(b) whether you are , or another entity is , entitled to an offset under Division 45 (low profit offsets) or Division 225 (rehabilitation tax offsets) of the Minerals Resource Rent Tax Act 201 2 .

(2) If the necessary records of an act, transaction, event or circumstance:

(a) do not already exist--you must create them or have someone else create them; or

(b) no longer exist--you must reconstruct them or have someone else reconstruct them.

(3) If you make any choice, election, estimate, determination or calculation under the * MRRT law, you must keep records containing particulars of:

(a) the choice, election, estimate, determination or calculation; and

(b) in the case of an estimate, determination or calculation--the basis on which, and the method by which, the estimate, determination or calculation was made.

(4) The records must be:

(a) in English, or readily accessible and easily convertible into English; and

(b) such as to enable the things mentioned in subsection ( 1) or (3) (as the case requires) to be readily ascertained.

You must retain the records required by section 123 - 5 until the latest of the following:

(a) if it is a record mentioned in subsection ( 1) of that section--5 years after the completion of the act, transaction, event or circumstance to which it relates;

(b) if it is a record mentioned in subsection ( 3) of that section--5 years after the choice, election, estimate, determination or calculation was made;

(c) 5 years after you prepared or obtained the records;

(d) if the records are relevant to an assessment of * MRRT for an * MRRT year--the end of the * period of review for that assessment.

123 - 15 Offence for failing to keep or retain records

(1) An entity commits an offence if:

(a) the entity is required to keep or retain a record under this Division; and

(b) the entity does not keep or retain the record i n accordance with this Division; and

(c) the Commissioner has not notified the entity that the entity does not need to retain the record; and

(d) the entity is not a company that has been finally dissolved.

Penalty: 30 penalty units.

(2) Subsection ( 1) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

(3 ) For the purposes of section 288 - 25, section 123 - 10 does not require an entity to retain a record if:

(a) the Commissioner notifies the entity that the entity does not need to retain the record; or

(b) the entity is a company that has been finally dissolved.

Note: Section 288 - 25 imposes an administrative penalty if an entity does not keep or retain records as required by this Division.

Table of sections

125 - 1 Address for service

(1) Your address for service for the purposes of the * MRRT law is:

(a) a physical address in Australia; or

(b) a postal address in Australia; or

(c) an electronic address;

that you have given the Commissioner as your address f or service for the purposes of the MRRT law.

(2) If you have given the Commissioner more than one address for service for the purposes of subsection ( 1), your address for service is such of those addresses as the Commissioner considers reasonable in the circumstances.

(3) If you have not given the Commissioner an address for service, your address for service is the address that the Commissioner reasonably believes to be your address f or service for the purposes of the * MRRT law.

(4) For the purposes of the * MRRT law, a document (however described) may be given :

(a) in the manner specified in section 28A of the Acts Interpretation Act 1901 ; or

(b) if your address for service is an electronic address--by sending it to that address.

(5) Despite section 29 of the Acts Interpretation Act 1901 , a document under subsection ( 4 ) of this section is taken to be given at the time the Commissioner leaves or posts it.

(6) This section has effect despite paragraphs 9(1)(d) and 9(2)(d) of the Electronic Transactions Act 1999 .

9 Subsection 250 - 10(2) in Schedule 1 (after table item 39B)

Insert:

39C | MRRT | 50 - 5 | Minerals Resource Rent Tax Act 201 2 |

39D | shortfall interest charge on shortfall in MRRT | 50 - 10 | Minerals Resource Rent Tax Act 201 2 |

10 Subsection 250 - 10(2) in Schedule 1 (after table item 135)

Insert:

136 | quarterly MRRT instalment | 115 - 25 in Schedule 1 |

11 Section 280 - 1 in Schedule 1

After " income tax, " , insert " minerals resource rent tax, " .

12 Section 280 - 50 in Schedule 1

After " income tax, " , insert " * MRRT, " .

13 After section 280 - 100 in Schedule 1

Insert:

280 - 101 Liability to shortfall interest charge--minerals resource rent tax

(1) You are liable to pay * shortfall interest charge on an additional amount of * MRRT that you are liable to pay because the Commissioner amends your assessment for an * MRRT year.

(2) The liability is for each day in the period:

(a) beginning at the start of the day on which * MRRT under your first assessment for that * MRRT year was due to be paid, or would have been due to be paid if there had been any; and

(b) ending at the end of the day before the day on which the Commissioner gave you notice of the amended assessment.

(3) However, if an amended assessment reinstates all or part of a liability in relation to a particular that had been reduced by an earlier amended assessment, the period for the reinstated liability begins at the start of the day on which * MRRT under the earlier amended assessment was due to be paid, or would have been due to be paid if there had been any.

Note: See Division 50 of the Minerals Resource Rent Tax Act 201 2 for when the amount of assessed MRRT and shortfall interest charge becomes due and payable. That Division also provides for general interest charge on any part of the additional amount (plus any shortfall interest charge) that remains unpaid after the additional amount is due and payable.

14 Paragraph 280 - 105(1)(a) in Schedule 1

After " income tax, " , insert " * MRRT, " .

15 Subsection 280 - 110(1) in Schedule 1

After " 280 - 100, " , insert " 280 - 101, " .

16 Section 280 - 170 in Schedule 1

After " income tax, " , insert " * MRRT, " .

17 At the end of section 284 - 30 in Schedule 1

Add:

Note: A beneficiary of a trust cannot have a * shortfall amount or * scheme shortfall amount in relation to the MRRT law .

18 At the end of section 284 - 35 in Schedule 1

Add:

Note: For the purposes of the MRRT law, under section 220 - 5 of the Minerals Resource Rent Tax Act 201 2 acts and omissions of partners in a partnership are taken to be acts or omissions of the partnership. Section 444 - 30 in this Schedule deals with the liability of partners for the obligations imposed on a partnership under the MRRT law.

19 Paragraph 284 - 75(2)(a) in Schedule 1

After " * income tax law " , insert " or the * MRRT law " .

20 P aragraph 284 - 75(2)(b) in Schedule 1

Omit " * income tax law " , substitute " income tax law, or the MRRT law, " .

21 Subsection 284 - 80(1) in Schedule 1 (table items 3 and 4) and s ubsection 284 - 90(1) in Schedule 1 (table item 4)

After " * income tax law " (wherever occurring) , insert " , or the * MRRT law, " .

22 S ubsection 284 - 90(1) in Schedule 1 (table item 4)

After " income tax payable " insert " , or * MRRT payable, " .

23 Subsection 284 - 90(1) in Schedule 1 (table item 4)

After " * income tax return " , insert " or * MRRT return " .

24 After subsection 286 - 75(2) in Schedule 1

Insert:

(2AA) You are also liable to an administrative penalty if:

(a) you are required under Division 121 (MRRT reporting) to give information to an entity (other than the Commissioner) in a particular form by a particular day; and

(b) you do not give the information to the entity in that form by that day.

25 Paragraph 286 - 80(2)(a) in Schedule 1

After " 286 - 75 (1), " , insert " (2AA), " .

26 Section 352 - 1 in Schedule 1

After " indirect tax laws " , insert " and the MRRT law " .

27 At the end of Division 352 in Schedule 1

Add:

Subdivision 352 - B -- Accountability of the Commissioner in respect of MRRT law

Table of sections

352 - 10 Commissioner must prepare annual report on MRRT law

352 - 10 Commissioner must prepare annual report on MRRT law

(1) As soon as practicable after 30 June in each year, the Commissioner must prepare and give to the Minister a report on the working of the * MRRT law during the year ending on that 30 June.

(2) The report must include a report on any breaches or evasions of the * MRRT law that the Commissioner knows about.

(3) The Minister must cause a copy of the report to be laid before each House of the Parliament within 15 sitting days of that House after the day on which the Minister receives the report.

28 Subsection 353 - 10(1) in Schedule 1

Repeal the subsection ( including the note) , substitute:

(1) The Commissioner may by notice in writing require you to do all or any of the following:

(a) to give t he Commissioner any information that the Commissioner requires for the purpose of the administration or operation of :

(i) an * indirect tax law; or

(ii) the * MRRT law; or

(iii) this Schedule (other than Division 340);

(b) to attend and give evidence before the Commissioner, or an individual authorised by the Commissioner, for the purpose of the administration or operation of :

(i) an indirect tax law; or

(ii) the MRRT law; or

(iii) this Schedule (other than Division 340);

(c) to produce to the Commissioner any documents in your custody or under your control for the purpose of the administration or operation of :

(i) an indirect tax law; or

(ii) the MRRT law; or

(iii) this Schedule.

Note: Failing to comply with a requirement can be an offence under section 8C or 8D .

29 Section 353 - 15 in Schedule 1 (heading)

Repeal the heading, substitute:

353 - 15 Access to premises for the purposes of the indirect tax laws and the MRRT law

30 Subsection 353 - 15(1) in Schedule 1

After " tax law " , insert " or the * MRRT law " .

31 After section 353 - 15 in Schedule 1

Insert:

353 - 17 Offshore information notices

For the purposes of the * MRRT law, section 264A (about offshore information notices) of the Income Tax Assessment Act 1936 applies as if:

(a) a reference to a taxpayer in that section were a re ference to an entity ; and

(b) a reference to an assessment in that section were a reference to an assessment under Division 155 of this Schedule relating to * MRRT ; and

(c) a reference to the Income Tax Assessment Act 1936 in that section were a reference to the MRRT law.

32 After paragraph 357 - 55(f) in Schedule 1

Insert:

(faa) * MRRT;

33 Subsection 360 - 5(1) in Schedule 1

After " relevant provision " , insert " (other than a provision about * MRRT) " .

34 Section 444 - 1 in Schedule 1

After " incapacitated entities " , insert " , trusts " .

35 Subsection 444 - 5(1) in Schedule 1

After " this Schedule " , insert " , the * MRRT law " .

36 After subsection 444 - 5(1) in Schedule 1

Insert:

(1A) An amount that is payable under the * MRRT law by an unincorporated association or body of entities is payable by each member of the committee of management of the association or body.

(1B) If there is more than one such member, those members are jointly and severally liable to pay the amount.

37 Subsection 444 - 5(2) in Schedule 1

After " this Schedule " , insert " , the * MRRT law " .

38 Subsections 444 - 10(1) and (2) in Schedule 1

After " an * indirect tax law " , insert " and the * MRRT law " .

39 Subsection 444 - 10(3) in Schedule 1

After " an * indirect tax law " , insert " or the * MRRT law " .

40 Subsection 444 - 10(5) in Schedule 1

After " an * indirect tax law " , insert " and the * MRRT law " .

41 Subsection 444 - 15(1) in Schedule 1

After " an * indirect tax law " , insert " or the * MRRT law " .

42 Subsections 444 - 30(1), (2) and (3) in Schedule 1

After " this Schedule " , insert " , the * MRRT law " .

43 Subsections 444 - 70(1) and (2) in Schedule 1

After " an * indirect tax law " , insert " or the * MRRT law " .

44 At the end of Division 444 in Schedule 1

Add:

Table of sections

444 - 120 Trusts

Obligations

(1) Subject to subsection ( 2), an obligation that is imposed under the * MRRT law on a trust is imposed on each of the following entities, but may be discharged by any such entity:

(a) an entity that is the trustee of the trust at the time the obligation arises;

(b) an entity that is the trustee of the trust at a time that is:

(i) after the obligation arises; and

(ii) before the obligation has been discharged.

(2) An amount that is payable under the * MRRT law by a trust is payable as set out in the table:

Amounts payable by trusts | ||

Column 1 If the amount that is payable by the trust under the MRRT law is: | Column 2 then it is payable by: | |

1 | * MRRT for an * MRRT year

| each of the following entities: (a) an entity that is the trustee of the trust at the end of the MRRT year; (b) an entity that is the trustee of the trust at a time that is: (i) after the end of the MRRT year; and (ii) before the MRRT has been paid. |

2 | * general interest charge on the unpaid amount of * MRRT for an * MRRT year | each of the following entities: (a) an entity that is the trustee of the trust at the end of the MRRT year; (b) an entity that is the trustee of the trust at a time that is: (i) after the end of the MRRT year; and (ii) before the general interest charge has been paid. |

3 | * shortfall interest charge in relation to an * MRRT year | each of the following entities: (a) an entity that is the trustee of the trust at the end of the MRRT year; (b) an entity that is the trustee of the trust at a time that is: (i) after the end of the MRRT year; and (ii) before the shortfall interest charge has been paid. |

an instalment for an * instalment quarter payable under Division 1 15 | each of the following entities: (a) an entity that is the trustee of the trust at the end of the instalment quarter; (b) an entity that is the trustee of the trust at a time that is: (i) after the end of the instalment quarter; and (ii) before the instalment has been paid. | |

5 | * general interest charge on the unpaid amount of an instalment referred to in table item 4 | each of the following entities: (a) an entity that is the trustee of the trust at the end of the instalment quarter; (b) an entity that is the trustee of the trust at a time that is: (i) after the end of the instalment quarter; and (ii) before the general interest charge has been paid. |

Joint and several liability

(3) If an amount is payable under this section by more than one entity, those entities are jointly and severally liable to pay the amount.

Commissioner has direct access to trust assets

(4) For the purpose of ensuring the payment of an amount payable by an entity under this section in relation to a liability of a trust, the Commissioner has the same remedies against the property of the trust as the Commissioner would have against the property of the entity.

Right of indemnity

(5) An entity that pays an amount of a liability it has under this section is entitled to be indemnified out of the assets of the trust for the liability.

Offences

(6) Any offence against the * MRRT law that is committed by a trust is taken to have been committed by the trustee of the trust, or, if the trust has more than one trustee, by each of the trustees.

(7) In a prosecution of an entity for an offence that the entity is taken to have committed because of subsection ( 6), it is a defence if the entity proves that the entity:

(a) did not aid, abet, counsel or procure the relevant act or omission; and

(b) was not in any way knowingly concerned in, or party to, the relevant act or omission (whether directly or indirectly and whether by any act or omission of the entity).

Note 1: The defence in subsection ( 7 ) does not apply in relation to offences under Part 2.4 of the Criminal Code .

Note 2: A defendant bears a legal burden in relation to the matters in subsection ( 7 ): see section 13.4 of the Criminal Code .