Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAdministrative Decision s (Judicial Review) Act 1977

1 Paragraph ( e) of Schedule 1

After:

Income Tax Assessment Act 1997

insert:

Minerals Resource Rent Tax Act 201 2

A New Tax System (Goods and Services Tax) Act 1999

2 At the end of section 177 - 12

Add:

; or (i) the Minerals Resource Rent Tax Act 201 2 .

Crimes (Taxation Offences) Act 1980

3 Subsection 3(1)

Insert :

"MRRT" means:

(a) MRRT within the meaning of the Minerals Resource Rent Tax Act 201 2 ; and

(b) shortfall interest charge (within the meaning of subsection 995 - 1(1) of the Income Tax Assessment Act 1997 ) under section 280 - 101 in Schedule 1 to the Taxation Administration Act 1953 ; and

(c) an instalment under Division 115 in that Schedule.

4 Subsection 3(1)

Insert :

"MRRT law" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

5 Part II ( at the end of note to heading )

Add :

; (j) minerals resource rent tax (see Part XI).

6 At the end of the Act

Add:

Part XI -- Offences relating to minerals resource rent tax

21 Application of Part I and Part II in relation to minerals resource rent tax

(1) Without prejudice to their effect apart from this section, subsection 3(3), paragraph 3(4)(e) and the provisions of Part II (other than section 8 and subsection 10(3)) also have the effect they would have if:

(a) a reference in any of those provisions to income tax were a reference to MRRT; and

(b) a reference in any of those provisions to future income tax were a reference to future MRRT; and

(c) a reference in any of those provisions to the Income Tax Assessment Act were a reference to the MRRT law; and

(d) a reference in any of those provisions, in relation to a company or trustee, to income tax moneys were a reference to MRRT moneys.

(2) In applying the provisions of Part II (other than section 8 and subsection 10(3)) in accordance with subsection ( 1) of this section:

(a) a reference in any of those provisions to the MRRT payable by a company or trustee, in relation to the intention of a person entering into, or the knowledge or belief of a person concerning, an arrangement or transaction is to be read as a reference to some or all of the MRRT due and payable by the company or the trustee at the time when the arrangement or transaction was entered into; and

(b) a reference in any of those provisions to future MRRT payable by a company or trustee, in relation to the intention of a person entering into, or the knowledge or belief of a person concerning, an arrangement or transaction is to be read as a reference to some or all of the MRRT that may reasonably be expected by that person to become payable by the company or trustee after the arrangement or transaction is entered into; and

(c) a reference in any of those provisions, other than subsections 10(1) and (2), in relation to a company or trustee, to MRRT moneys is to be read as a reference to:

(i) MRRT payable by the company or trustee; and

(ii) costs ordered by a court against a company or trustee in a proceeding for the recovery of MRRT; and

(d) a reference in subsections 10(1) and (2) to MRRT moneys shall be read as a reference to MRRT that has been assessed under Schedule 1 to the Taxation Administration Act 1953 .

(3) In applying subsection 10(2), and section s 11 and 12 , in accordance with subsections ( 1) and (2) of this section, the liability of a company or trustee in respect of MRRT moneys that have been assessed is not to be taken not to be finally determined merely because of the possibility of the Commissioner amending the assessment (otherwise than as a result of an objection being allowed or to give effect to a decision of the Administrative Appeals Tribunal or a court).

Income Tax Assessment Act 1997

7 Section 10 - 5 (after table item headed " meals " )

Insert:

minerals resource rent tax |

|

refund of excess rehabilitation tax offsets | 15 - 85 |

8 Section 12 - 5 (table item headed " capital allowances " )

After:

low - value and software development pools ... | Subdivision 40 - E |

insert:

Minerals Resource Rent Tax ................... | 40 - 751 |

9 At the end of Division 15

Add:

15 - 85 Refunded excess rehabilitation tax offset

Your assessable income includes an amount the Commissioner pays you under paragraph 225 - 25(2)(b) of the Minerals Resource Rent Tax Act 201 2 .

Note: You can get a refund of excess rehabilitation tax offsets under section 225 - 25 of the Minerals Resource Rent Tax Act 201 2 .

10 Section 40 - 40 (table item 8)

Omit " * mining operations " , substitute " * mining and quarrying operations " .

11 Subsection 40 - 70(3)

Omit " base value in the formula in subsection ( 1) " , substitute " * base value " .

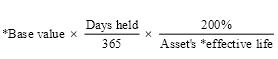

12 Subsection 40 - 72(1) (formula)

Repeal the formula, substitute:

13 Subsection 40 - 72(1)

Omit " base value has the same meaning as in subsection 40 - 70(1). "

14 Subsection 40 - 72(3)

Omit " base value in the formula in subsection ( 1) " , substitute " * base value " .

15 Paragraph 40 - 80(1)(a)

After " * mining " , insert " and quarrying " .

16 Subparagraph 40 - 80(1)(c)(i)

Omit " mining operations " , substitute " mining and quarrying operations " .

17 Subsection 40 - 95(10) (table items 1, 2 and 3)

Omit " * mining operations " , substitute " * mining and quarrying operations " .

18 Subsection 40 - 102(4) (table item 9)

After " * mining " , insert " and quarrying " .

19 Paragraph 40 - 630(1)(b)

After " * mining " , insert " and quarrying " .

20 Subsection 40 - 630(1) ( paragraph ( a) of the note)

After " mining " , insert " and quarrying " .

21 Paragraphs 40 - 630(1A)(b), (1B)(b) and (3)(b)

After " * mining " , insert " and quarrying " .

22 Paragraph 40 - 650(3)(a)

After " * mining " , insert " and quarrying " .

23 Section 40 - 725

After:

• paying petroleum resource rent tax; and

insert:

• paying minerals resource rent tax; and

24 Subsection 40 - 730(1)

After " * mining " , insert " and quarrying " .

25 Paragraph 40 - 730(1)(a)

After " mining " , insert " and quarrying " .

26 Subsection 40 - 730(7)

After " Mining " , insert " and quarrying " .

27 Subparagraph 40 - 735(1)(a)(i)

After " * mining " , insert " and quarrying " .

28 Subsection 40 - 735(4)

After " * mining " , insert " and quarrying " .

29 Paragraph 40 - 740(1)(a)

After " * mining " , insert " and quarrying " .

30 Paragraphs 40 - 740(1)(b), (c) and (e)

After " mining " , insert " and quarrying " .

31 Subsection 40 - 740(2)

After " * mining " , insert " and quarrying " .

32 After section 40 - 750

Insert:

40 - 751 Deduction for payments of minerals resource rent tax

(1) You can deduct a payment of * MRRT, or an instalment of MRRT payable under Division 115 in Schedule 1 to the Taxation Administration Act 1953 , that you make in an income year.

Note: If an amount of the expenditure is recouped, the amount may be included in your assessable income: see Subdivision 20 - A. Similarly, a refund of excess rehabilitation tax offsets you get under section 225 - 25 of the Minerals Resource Rent Tax Act 201 2 is assessable income: see section 15 - 85.

(2) If you deduct an instalment of * MRRT under subsection ( 1), you cannot also deduct any of the following amounts when applied under Division 3 of Part IIB of the Taxation Administration Act 1953 :

(a) the amount of the payment of the instalment;

(b) the amount of a credit arising under section 115 - 20 in Schedule 1 to the Taxation Administration Act 1953 in respect of the instalment.

(3) If you deduct a payment of * MRRT under subsection ( 1), you cannot also deduct the corresponding amount applied under Division 3 of Part IIB of the Taxation Administration Act 1953 .

33 Subparagraph 40 - 840(1)(c)(i)

After " * mining " , insert " and quarrying " .

34 Paragraph 40 - 860(1)(a)

After " * mining " , insert " and quarrying " .

35 Subsection 40 - 860(2)

After " * mining " , insert " and quarrying " .

36 Paragraph 40 - 860(3)(a)

After " * mining " , insert " and quarrying " .

37 Paragraph 40 - 860(3)(c)

After "mining", insert "and quarrying".

38 Paragraphs 40 - 870(1)(a) and (2)(a)

After " * mining " , insert " and quarrying " .

39 Subsection 250 - 105(1)

Repeal the subsection, substitute:

(1) For the purposes of section 250 - 40, the discount rate to be used in working out the present value of a future amount is the * long term bond rate for the * financial year in which the relevant * arrangement period starts.

40 Subsection 703 - 50(1) (note)

After " Note " , insert " 1 " .

41 At the end of subsection 703 - 50(1)

Add:

Note 2: A group that is consolidated for income tax purposes may also consolidate for the purposes of the Minerals Resource Rent Tax Act 201 2 (see section 215 - 10 of that Act).

42 Subsection 719 - 50(1) (note)

After " Note " , insert " 1 " .

43 At the end of subsection 719 - 50(1)

Add:

Note 2: A group that is consolidated for income tax purposes may also consolidate for the purposes of the Minerals Resource Rent Tax Act 201 2 (see section 215 - 10 of that Act).

44 Subsection 721 - 10(2) (table item 70)

Repeal the item, substitute:

70 | Division 280 in Schedule 1 to the Taxation Administration Act 1953 (shortfall interest charge) | the period provided for in this table for the * tax - related liability to which the shortfall interest charge relates |

75 | section 50 - 5 of the Minerals Resource Rent Tax Act 201 2 (when assessed MRRT is payable) | the * MRRT year to which the * assessed MRRT relates |

80 | section 50 - 10 of the Minerals Resource Rent Tax Act 201 2 (shortfall interest charge on shortfall in assessed MRRT) | the * MRRT year to which the * shortfall interest charge relates |

85 | section 115 - 25 in Schedule 1 to the Taxation Administration Act 1953 (when MRRT instalments are due) | the * instalment quarter to which the instalment relates |

45 At the end of section 721 - 10

Add:

(4) Items 75, 80 and 85 of the table in subsection ( 2) apply in relation to tax - related liabilities that are due and payable by the * head company because it chooses, under section 215 - 10 of the Minerals Resource Rent Tax Act 201 2 , to apply Division 215 of that Act in relation to the * consolidated group.

46 After subsection 721 - 25(1A)

Insert:

(1AA ) The requirement in paragraph ( 1)(c) is also taken to be satisfied if:

(a) the group liability is a * tax - related liability mentioned in item 75 of the table in subsection 721 - 10(2) in relation to an * MRRT year; and

(b) before, at or after the head company ' s due time, the * head company of the group became entitled to a credit under section 115 - 20 in Schedule 1 to the Taxation Administration Act 1953 for that MRRT year; and

(c) just before the head company ' s due time, the contribution amounts for each of the TSA contributing members in relation to the group liability, as determined under the agreement, represented a reasonable allocation among the head company and the TSA contributing members of the difference between:

(i) the total amount of the group liability; and

(ii) the amount of the credit mentioned in paragraph ( b).

47 Subsections 721 - 25(1B), (2) and (3)

Omit "and (1A)", substitute ", (1A) and (1AA)" .

48 Subsection 995 - 1(1)

Insert:

"allowance component" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

49 Subsection 995 - 1(1)

Insert:

"applicable instalment rate" for an * instalment quarter in an * MRRT year has the meaning given by section 115 - 45 in Schedule 1 to the Taxation Administration Act 1953 .

50 Subsection 995 - 1(1)

Insert:

"arm's length consideration" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

51 Subsection 995 - 1(1)

Insert:

"base value" :

(a) of a * depreciating asset--has the meaning given by subsection 40 - 70(1); and

(b) of a * starting base asset -- has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

52 Subsection 995 - 1(1) (definition of base year )

Repeal the definition, substitute:

"base year" :

(a) for an entitlement to a * tax offset under Subdivision 61 - I--has the meaning given by sections 61 - 430 and 61 - 450; and

(b) in relation to an income year--has the meaning given by sections 45 - 320 and 45 - 470 in Schedule 1 to the Taxation Administration Act 1953 ; and

(c) in relation to an * MRRT year--has the meaning given by sub section 115 - 75 (3) in Schedule 1 to the Taxation Administration Act 1953 .

53 Subsection 995 - 1(1) (definition of benchmark instalment rate )

Repeal the definition, substitute:

"benchmark instalment rate" :

(a) in relation to an income year--has the meaning given by sections 45 - 360 and 45 - 530 in Schedule 1 to the Taxation Administration Act 1953 ; and

(b) in relation to an * MRRT year--has the meaning given by section 115 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

54 Subsection 995 - 1(1) (definition of instalment income )

Repeal the definition, substitute:

"instalment income" :

(a) in relation to a period that is, or is part of, an income year--has the meaning given by sections 45 - 120, 45 - 260, 45 - 280, 45 - 285, 45 - 286 and 45 - 465 in Schedule 1 to the Taxation Administration Act 1953 ; and

(b) in relation to an * instalment quarter of an * MRRT year--has the meaning given by sections 115 - 40 and 115 - 95 in Schedule 1 to the Taxation Administration Act 1953 .

55 Subsection 995 - 1(1) (definition of instalment quarter )

Repeal the definition, substitute:

"instalment quarter" :

(a) in relation to an income year--has the meaning given by section 45 - 60 in Schedule 1 to the Taxation Administration Act 1953 ; and

(b) in relation to an * MRRT year--has the meaning given by subsection 115 - 10 (2) and section 115 - 110 in Schedule 1 to the Taxation Administration Act 1953 .

56 Subsection 995 - 1(1)

Insert:

"long term bond rate" , for a period, means:

(a) the average, expressed as a decimal fraction to 4 decimal places (rounding up if the fifth decimal place is 5 or more), of the daily assessed Australian Government bond capital market yields in respect of 10 - year non - rebate Treasury bonds published by the Reserve Bank in relation to the period; or

(b) if no such yields in respect of bonds of that kind were published by the Reserve Bank in relation to the period, the decimal fraction determined by the Minister by legislative instrument for the purposes of this definition in relation to the period.

57 Subsection 995 - 1(1)

Insert:

"miner" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

58 Subsection 995 - 1(1)

Insert:

"mining and quarrying operations" has the meaning given by section 40 - 730.

59 Subsection 995 - 1(1)

Insert:

"mining expenditure" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

60 Subsection 995 - 1(1)

Insert:

"mining loss" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

61 Subsection 995 - 1(1) (definition of mining operations )

Repeal the definition.

62 Subsection 995 - 1(1)

Insert:

"mining profit" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

63 Subsection 995 - 1(1)

Insert:

"mining project interest" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

64 Subsection 995 - 1(1)

Insert:

"mining project split" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

65 Subsection 995 - 1(1)

Insert:

"mining project transfer" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

66 Subsection 995 - 1(1)

Insert:

"mining revenue" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

67 Subsection 995 - 1(1)

Insert:

"mining revenue event" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

68 Subsection 995 - 1(1)

Insert:

"MRRT" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

69 Subsection 995 - 1(1)

Insert:

"MRRT allowance" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

70 Subsection 995 - 1(1)

Insert:

"MRRT law" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

71 Subsection 995 - 1(1)

Insert:

"MRRT liability" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

72 Subsection 995 - 1(1)

Insert:

"MRRT payable" , by a * miner for an * MRRT year, means the sum of the * MRRT liabilities f or each * mining project interest the miner has for that year, less the sum of any offsets the miner has for that year under Division 45 or 225 of the Minerals Resource Rent Tax Act 201 2 .

73 Subsection 995 - 1(1)

Insert:

"MRRT return" means a return of the kind referred to in Division 117 in Schedule 1 to the Taxation Administration Act 1953 , that complies with all the require ments of sections 117 - 10 and 117 - 2 5 (if applicable) in that Schedule and section 388 - 75 in that Schedule.

74 Subsection 995 - 1(1)

Insert:

"MRRT year" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

75 Subsection 995 - 1(1)

Insert:

"pre-mining expenditure" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

76 Subsection 995 - 1(1)

Insert:

"pre-mining project interest" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

77 Subsection 995 - 1(1)

Insert:

"pre-mining revenue" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

78 Subsection 995 - 1(1)

Insert:

"rehabilitation tax offset" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

79 Subsection 995 - 1(1)

Insert:

"split percentage" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

80 Subsection 995 - 1(1)

Insert:

"starting base asset" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

81 Subsection 995 - 1(1)

Insert:

"starting base return" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

82 Subsection 995 - 1(1) (definition of start time )

Repeal the definition, substitute:

"start time" :

(a) of a * depreciating asset--has the meaning given by section 40 - 60; and

(b) of a * starting base asset relating to a * mining project interest -- has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

83 Subsection 995 - 1(1)

Insert:

"taxable mining profit" , of a miner for an * MRRT year, means the sum of the following for each * mining project interest the miner has for that year:

(a) the * mining profit for that interest for that year; less

(b) the * MRRT allowances for that interest for that year.

84 Subsection 995 - 1(1)

Insert:

"taxable resource" has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

85 Subsection 995 - 1(1) (definition of termination value )

Repeal the definition, substitute:

"termination value" :

(a) of a * depreciating asset--has the meaning given by section 40 - 300; and

(b) of a * starting base asset--has the meaning given by section 300 - 1 of the Minerals Resource Rent Tax Act 201 2 .

Taxation (Interest on Overpayments and Early Payments) Act 1983

86 Subsection 3(1) ( paragraph ( d) of the definition of decision to which this Act applies )

After " item 120 " , insert " or 160 " .

87 Section 3C

Before " In " , insert " (1) " .

88 Section 3C (at the end of the table)

Add:

160 | assessed MRRT within the meaning of the Minerals Resource Rent Tax Act 201 2 |

89 At the end of section 3C

Add:

(2) Without limiting subsection ( 1) , a reference in item 160 of the table to assessed MRRT includes :

(a) any general interest charge due and payable in relation to such an amount; and

(b) a quarterly MRRT instalment that is due under section 115 - 25 in Schedule 1 to the Taxation Administration Act 1953 ; and

(c) any general interest charge due and payable in relation to such an instalment.

Part 2 -- Amendments with other commencements

Administrative Decisions (Judicial Review) Act 1977

90 Paragraph ( e) of Schedule 1

After "Part 3 - 10", insert ", 3 - 15".

Income Tax Assessment Act 1997

91 Subsection 995 - 1(1) (at the end of the definition of hold )

Add:

; and (d) hold a thing mentioned in subsection 250 - 5(2) of the Minerals Resource Rent Tax Act 201 2 has the meaning given by sections 250 - 5 and 250 - 10 of that Act.

Note: The things mentioned in subsection 250 - 5(2) of that Act are starting base assets, an asset to which section 175 - 40 of that Act applies and a pre - mining project interest.

Minerals Resource Rent Tax Act 201 2

92 At the end of Division 35

Add:

35 - 80 Unit shortfall charge--clean energy

An amount of expenditure is excluded expenditure to the extent that it is unit shortfall charge (within the meaning of the Clean Energy Act 2011 ).