Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1936

1 Section 160APA ( paragraph ( baa) of the definition of applicable general company tax rate )

Omit "36%", substitute "34%".

2 Section 160APA ( paragraph ( cb) of the definition of applicable general company tax rate )

Omit "36%", substitute "34%".

3 At the end of section 160AQG

Add:

(4) If a company has a franking year that includes, but does not start on, 1 July 2000, subsections ( 1) to (3) apply to the company as if the following periods were separate franking years:

(a) the period starting at the start of the company's franking year and ending on 30 June 2000;

(b) the period starting on 1 July 2000 and ending at the end of the franking year.

4 Subparagraph 160AQH(1)(b)(iva)

Repeal the subparagraph, substitute:

(iva) if the dividend is a class C franked dividend--the amount worked out in relation to the dividend using the formula in subsection 160AQT(1AB) (whether or not that subsection applies to the dividend) and a statement to the effect that the applicable general company tax rate used in that formula was 34%; and

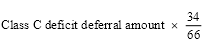

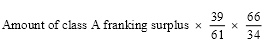

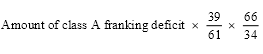

5 Subsection 160AQJC(4) (formula)

Repeal the formula, substitute:

6 Before section 160ASF

Insert:

160ASEA Some provisions of this Division cease to apply to events occurring on or after 1 July 2000

The following provisions of this Division do not apply to an event that occurs on or after 1 July 2000:

Provisions ceasing to apply from 1 July 2000 | ||

Item | Provision | Event |

1 | section 160ASI [see instead section 160ATD] | a class A or class B franking credit or debit arises after class C conversion time |

2 | section 160ASJ [see instead section 160ATE] | a company ceases to be a life assurance company |

7 Paragraph 160ASK(1)(e) (formula)

Repeal the formula, substitute:

8 Paragraph 160ASK(2)(e) (formula)

Repeal the formula, substitute:

9 Paragraph 160ASL(2)(a) (formula)

Repeal the formula, substitute:

10 Paragraph 160ASL(2)(b) (formula)

Repeal the formula, substitute:

11 Paragraph 160ASL(3)(a) (formula)

Repeal the formula, substitute:

12 Paragraph 160ASL(3)(b) (formula)

Repeal the formula, substitute:

13 At the end of Part IIIAA

Add:

Division 14 -- Transitional provisions for conversion to 34% rate on 1 July 2000

160ATA Conversion of account balances on 1 July 2000

(1) On 1 July 2000, a company's franking accounts are dealt with as follows:

(a) first:

(i) the company's class C franking account balance (if any) at the start of that day is converted under section 160ATB to reflect the new company tax rate; and

(ii) the company's venture capital sub - account balance (if any) at the start of that day is converted under section 160ATB to reflect the new company tax rate;

(b) then, any other credits and debits that occur on that day are processed.

(2) For the purposes of this Division, if 1 July 2000 is the first day of a franking year for the company, the balance in a franking account or sub - account of the company at the start of that day includes any credit arising for that account on that day under section 160APL (carry forward of surplus from previous franking year) or 160ASEE (carry forward of venture capital sub - account surplus from previous franking year).

(3) Section 160ATD tells you how to deal with franking credits and debits that arise on or after 1 July 2000 but reflect tax paid at the old company tax rates.

160ATB Conversion of balance of class C franking account to reflect the new company tax rate

(1) If a company has a class C franking surplus at the start of 1 July 2000:

(a) a class C franking debit of the company arises equal to that surplus; and

(b) a class C franking credit of the company arises equal to the amount of that debit multiplied by the conversion factor in subsection ( 5).

(2) If a PDF has a venture capital sub - account surplus at the start of 1 July 2000:

(a) a venture capital debit of the PDF arises equal to that surplus; and

(b) a venture capital credit of the PDF arises equal to the amount of that debit multiplied by the conversion factor in subsection ( 5).

(3) If a company has a class C franking deficit at the start of 1 July 2000:

(a) a class C franking credit of the company arises equal to that deficit; and

(b) a class C franking debit of the company arises equal to the amount of that credit multiplied by the conversion factor in subsection ( 5).

(4) If a PDF has a venture capital sub - account deficit at the start of 1 July 2000:

(a) a venture capital credit of the PDF arises equal to that deficit; and

(b) a venture capital debit of the PDF arises equal to the amount of that credit multiplied by the conversion factor in subsection ( 5).

(5) The conversion factor is:

160ATD Special treatment of some franking credits and debits arising on or after 1 July 2000

(1) If:

(a) any of the events specified in the event column of the following table occurs in relation to a company on or after 1 July 2000; and

(b) the event:

(i) is not a franking credit or debit arising under this Division; and

(ii) is not a franking credit arising under section 160APL; and

(iii) is not a franking debit arising under section 160APX, 160AQB, 160AQCB, 160AQCBA, 160AQCC, 160AQCNA, 160AQCNB or 160AQCNC;

the adjustments specified in the adjustments column for that item are made to the company's franking accounts:

Certain credits and debits arising on or after 1 July 2000 | ||

Item | Event | Adjustments |

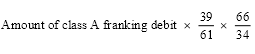

1 | a class A franking credit of the company arises under this Part and the company is not a life assurance company | (a) a class A franking debit arises equal to the amount of the class A franking credit; and (b) a class C franking credit also arises equal to the amount worked out using the formula:

|

2 | a class A franking debit of the company arises under this Part and the company is not a life assurance company | (a) a class A franking credit arises equal to the amount of the class A franking debit; and (b) a class C franking debit also arises equal to the amount worked out using the formula:

|

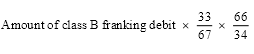

3 | a class B franking credit of a company arises under this Part | (a) a class B franking debit arises at that time equal to the amount of the class B franking credit; and (b) a class C franking credit also arises at that time equal to the amount worked out using the formula:

|

4 | a class B franking debit of a company arises under this Part | (a) a class B franking credit arises at that time equal to the amount of the class B franking debit; and (b) a class C franking debit also arises at that time equal to the amount worked out using the formula:

|

5 | a class C franking credit of a company arises under this Part and the amount of the credit reflects an applicable general company tax rate of 36% | (a) a class C franking debit arises at that time equal to the amount of the class C franking credit; and (b) a class C franking credit also arises at that time equal to the amount worked out using the formula:

|

6 | a class C franking debit of a company arises under this Part and the amount of the debit reflects an applicable general company tax rate of 36% | (a) a class C franking credit arises at that time equal to the amount of the class C franking debit; and (b) a class C franking debit also arises at that time equal to the amount worked out using the formula:

|

7 | a venture capital credit of the PDF arises under this Part and the amount of the credit reflects an applicable general company tax rate of 36% | (a) a venture capital debit of the PDF arises at that time equal to the amount of the venture capital credit; and (b) a venture capital credit of the PDF also arises at that time equal to the amount worked out using the formula:

|

8 | a venture capital debit of a PDF arises under this Part and the amount of the debit reflects an applicable general company tax rate of 36% | (a) a venture capital credit of the PDF arises at that time equal to the amount of the venture capital debit; and (b) a venture capital debit also arises at that time equal to the amount worked out using the formula:

|

(2) For the purposes of items 5, 6, 7 and 8 of the table in subsection ( 1), the amount of a credit or debit reflects an applicable general company tax rate of 36% if:

(a) the applicable general company tax rate used to calculate the amount of the debit or credit is 36%; or

(b) the credit or debit arises in relation to an estimated debit determination and the determination is made on the basis of:

(i) action seeking a reduction in an amount of company tax for a year of income for which the general company tax rate is 36%; or

(ii) a payment of an initial payment of tax or a company tax instalment in relation to a year of income for which the general company tax rate is 36%; or

(c) the debit arises under subsection 160AQC(3) or section 160ASEI and the amount specified in the application for the estimated debit concerned is taken to be based on a 36% general company tax rate under section 160ATI; or

(d) the credit or debit is equal to the amount of an earlier debit or credit and the earlier debit or credit reflected an applicable general company tax rate of 36%.

Note 1: Paragraph ( a)--the applicable general company tax rate will always be involved in the calculation of a credit or debit if an "adjusted amount" is used in the calculation.

Note 2: Paragraph ( d) covers provisions such as sections 160APV, 160APVB, 160APVF, 160AQCA, 160AQCCB and 160AQCM.

160ATE Provisions relating to companies that cease to be life assurance companies

Conversion of class A franking surplus

(1) If:

(a) a company is a life assurance company on 1 July 2000; and

(b) at a particular time (the transition time ) after 1 July 2000, the company ceases to be a life assurance company (other than by ceasing to be a company); and

(c) at the transition time the company has a class A franking surplus;

then, immediately after the transition time:

(d) a class A franking debit of the company equal to that class A franking surplus arises; and

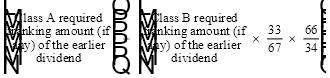

(e) a class C franking credit of the company also arises that is worked out using the formula:

Conversion of class A franking deficit

(2) If:

(a) a company is a life assurance company on 1 July 2000; and

(b) at a particular time (the transition time ) after 1 July 2000, the company ceases to be a life assurance company (other than by ceasing to be a company); and

(c) at the transition time the company has a class A franking deficit;

then, immediately after the transition time:

(d) a class A franking credit of the company arises equal to that class A franking deficit; and

(e) a class C franking debit of the company also arises that is worked out using the formula:

160ATF Series of dividends crossing over 1 July 2000

(1) This section deals with the situation in which:

(a) a company pays a number of class C franked dividends under a resolution made before 1 July 2000; and

(b) some of the dividends (the first series dividends ) are paid before 1 July 2000; and

(c) some of the dividends (the second series dividends ) are paid on or after 1 July 2000.

(2) For the purposes of this Part:

(a) the first series dividends and the second series dividends are to be taken to have been made under separate resolutions; and

(b) any declaration (the original declaration ) made under section 160AQF or 160ASEL in relation to the dividends is taken to have effect only in relation to the first series dividends; and

(c) if the company does not make a declaration under section 160AQF or 160ASEL in relation to the second series dividends before the reckoning day for the second series dividends, then:

(i) in a case where the first series dividends were class C franked dividends--the company is to be taken to have made a declaration under section 160AQF that each dividend in the second series is a class C franked dividend to the extent of the same percentage as in the original declaration; and

(ii) in a case where the first series dividends were also franked with a venture capital franked amount--the company is to be taken to have made a declaration under section 160ASEL that each dividend in the second series is a venture capital dividend to the extent of the same percentage as in the original declaration.

Note 1: Paragraph ( a) means that the 2 series of dividends will have separate reckoning days (see the definition of reckoning day in section 160APA). The reckoning day for the second series dividends will be the day on which the first of the second series dividends is paid. This in turn affects the calculation of the required franking amount for the second series dividends.

Note 2: Paragraph ( b) means that the company may make a fresh declaration under section 160AQF in relation to the second series dividends. The company may wish to do this to ensure that the second series dividends are franked to the new required franking amount that will need to be calculated under Division 4. It will also mean that the company may make a fresh declaration under section 160ASEL.

(1) This section deals with the situation in which:

(a) a company pays a class C franked dividend or class C franked dividends under a resolution made before 1 July 2000; and

(b) no dividend is paid under the resolution before 1 July 2000.

(2) For the purposes of this Part:

(a) despite subsection 160AQF(2), the company may:

(i) vary any declaration it made under section 160AQF or 160ASEL in relation to the dividend or dividends; or

(ii) revoke any declaration it made under section 160AQF or 160ASEL in relation to the dividend or dividends and make a fresh declaration under that section in relation to the dividend or dividends;

before the reckoning day for the dividend or dividends; and

(b) a declaration varied, or a fresh declaration made, under this section cannot itself be varied or revoked.

160ATH Modifying the operation of subsection 160AQE(3)

When this section applies

(1) This section deals with the situation in which:

(a) subsection 160AQE(3) is applied to work out the provisional required franking amount for a dividend (the current dividend ) paid on or after 1 July 2000; and

(b) the earlier franked dividend referred to in that subsection was paid before 1 July 2000.

Effect on required franking amount--companies other than life assurance companies

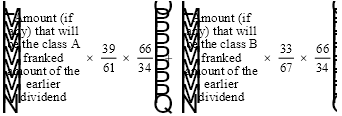

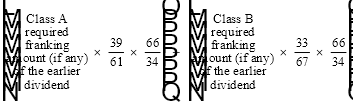

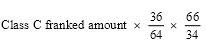

(2) If the company is not a life assurance company at the beginning of the reckoning day for the current dividend, the component EFA in the formula in subsection 160AQE(3) is worked out using the following formula:

where:

"class C franked amount" is the amount that is the class C franked amount of the earlier dividend.

Effect on required franking amount--life assurance companies

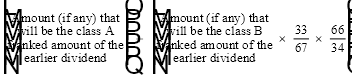

(3) If the company is a life assurance company at the beginning of the reckoning day for the current dividend, the component EFA in the formula in subsection 160AQE(3) is worked out using the following formula:

where:

"class A franked amount" is the amount (if any) that is the class A franked amount of the earlier dividend.

"class C franked amount" is the amount (if any) that is the class C franked amount of the earlier dividend.

An application made under section 160AQDAA or 160ASEK on or after 9 June 2000 and before 1 July 2000 may specify whether the amount specified in the application is based on a 36% or a 34% general company tax rate. If no rate is specified, the application is taken to specify that the amount specified in the application is based on a 36% general company tax rate.

14 Application of amendments

(1) The amendment made by item 1 applies to:

(a) franking deficit tax for franking years ending on or after 1 July 2000; and

(b) deficit deferral tax in relation to instalments under section 221AZK paid during a franking year ending on or after 1 July 2000.

(2) The amendment made by item 2 applies to:

(a) the payment of a class C franked dividend to a shareholder in a company on or after 1 July 2000; and

(b) a trust amount or partnership amount that relates, directly or indirectly, to the payment of a class C franked dividend to a shareholder in a company on or after 1 July 2000.

(3) The amendment made by item 4 applies to dividends paid on or after 1 July 2000.

(4) The amendment made by item 5 applies to deficit deferral tax in relation to instalments under section 221AZK paid during a franking year ending on or after 1 July 2000.

(5) The amendments made by items 7 and 8 apply to dividends paid on or after 1 July 2000.

(6) The amendments made by items 9 to 12 apply to dividends that are current dividends for the purposes of section 160ASL of the Income Tax Assessment Act 1936 and are paid on or after 1 July 2000.